Question: please answer both 1. AAA Stock pays dividends once a year. AAA paid $2.00 last year, and is projected to pay $2.20 next year. Based

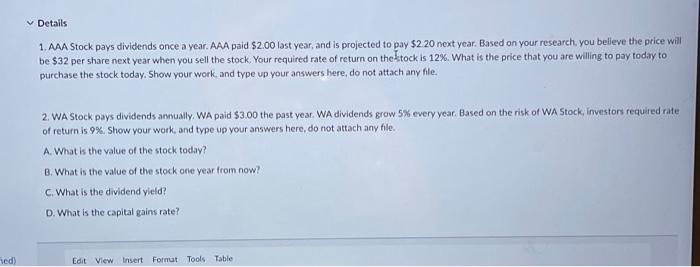

1. AAA Stock pays dividends once a year. AAA paid $2.00 last year, and is projected to pay $2.20 next year. Based on your research, you believe the price will be $32 per share next year when you sell the stock. Your required rate of return on the 5 tock is 12%. What is the price that you are willing to pay today to purchase the stock today. Show your work, and type up your answers here, do not attach any file. 2. WA Stock pays dividends annually. WA paid $3.00 the past year. WA dividends grow 5% every year. Based on the risk of WA 5 tock, investors required rate of return is 9%. Show your work, and type up your answers here, do not attach any file. A. What is the value of the stock today? B. What is the value of the stock one year from now? C. What is the dividend yield? D. What is the capital gains rate? 1. AAA Stock pays dividends once a year. AAA paid $2.00 last year, and is projected to pay $2.20 next year. Based on your research, you believe the price will be $32 per share next year when you sell the stock. Your required rate of return on the 5 tock is 12%. What is the price that you are willing to pay today to purchase the stock today. Show your work, and type up your answers here, do not attach any file. 2. WA Stock pays dividends annually. WA paid $3.00 the past year. WA dividends grow 5% every year. Based on the risk of WA 5 tock, investors required rate of return is 9%. Show your work, and type up your answers here, do not attach any file. A. What is the value of the stock today? B. What is the value of the stock one year from now? C. What is the dividend yield? D. What is the capital gains rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts