Question: please answer both! 1. Asset A has an expected return of 15% and a reward-to-variability ratio of 0.4. Asset B has an expected return of

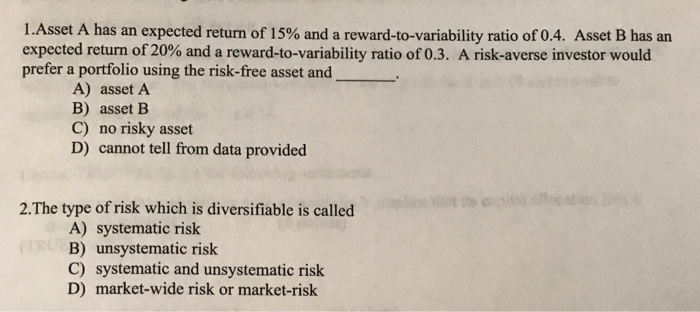

1. Asset A has an expected return of 15% and a reward-to-variability ratio of 0.4. Asset B has an expected return of 20% and a reward-to-variability ratio of 0.3. A risk-averse investor would prefer a portfolio using the risk-free asset and A) asset A B) asset B C) no risky asset D) cannot tell from data provided lo 2.The type of risk which is diversifiable is called A) systematic risk B) unsystematic risk C) systematic and unsystematic risk D) market-wide risk or market-risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts