Question: please answer both #2 & #3!! Journal entry worksheet Required information The following information applies to the questions displayed below: 1. On July 15, Piper

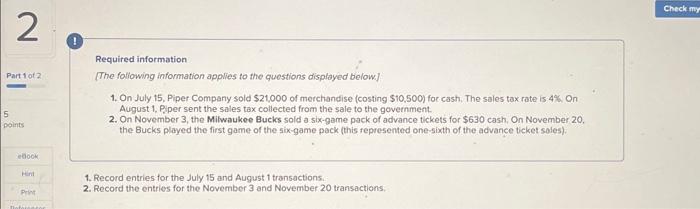

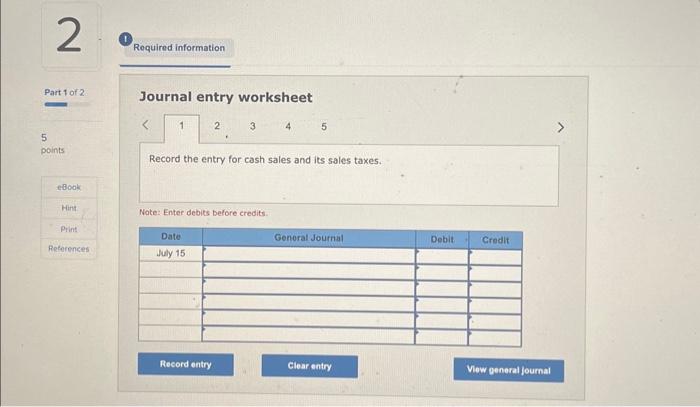

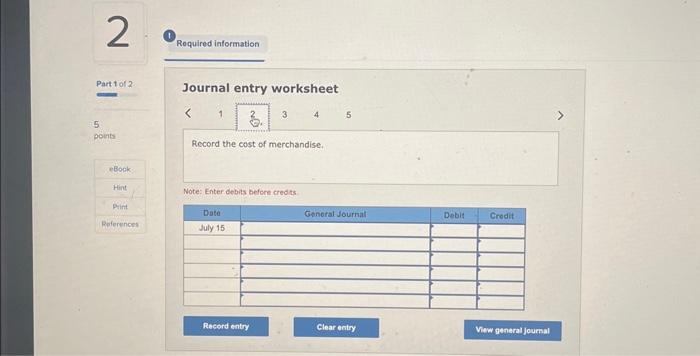

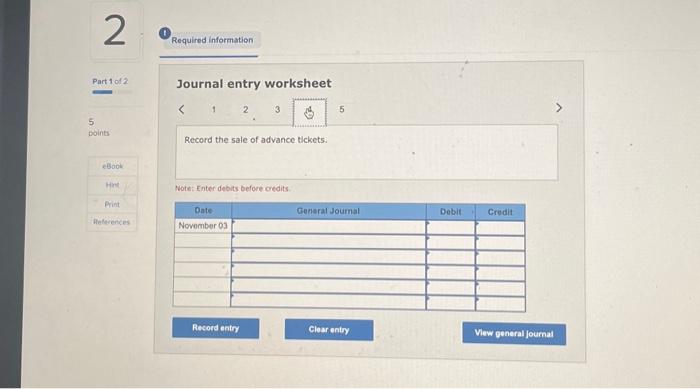

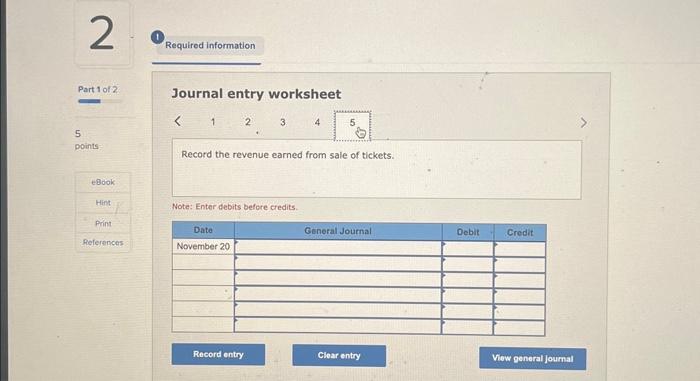

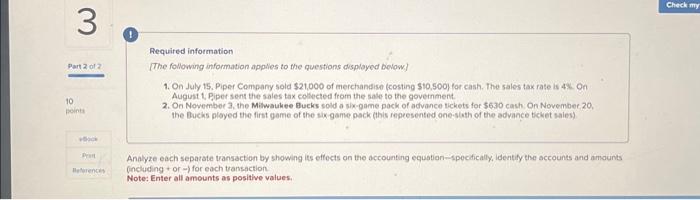

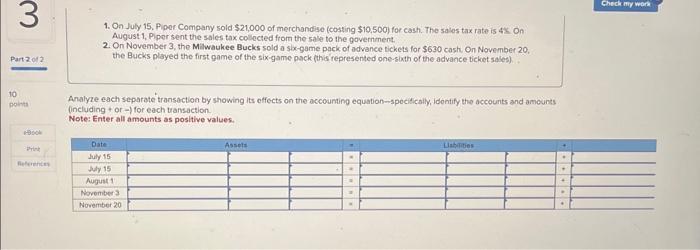

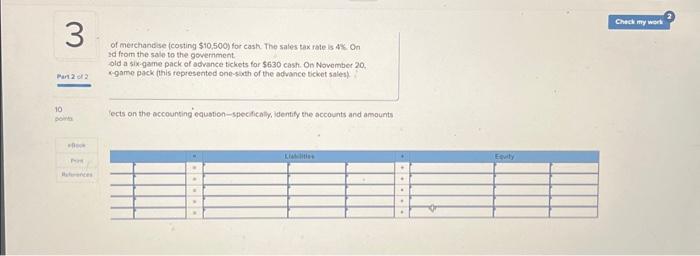

Journal entry worksheet Required information The following information applies to the questions displayed below: 1. On July 15, Piper Company sold $21,000 of enerchandise (costing $10,500 ) for cash, The sales tax rate is 4. On Augist t, Piper sent the sales tax collected from the sale to the government 2. On Novernber 3, the Milwaukee Bucks sold a six-game pock of advance tickets for $630 cach On November 20 , the Bucks ployed the first pame of the six-garne pack (this repeesented one-sith of the advance ticket males) Analyze each separate transaction by showing its effocts on the occounting equation-spoctically, identify the occounts and amounts (including + or for each transaction. Note: Enter all amounts as positive values. Journal entry worksheet 1 5 Record the sending of sales taxes to the government. Wole Enter debits betore credits. Journal entry worksheet Journal entry worksheet 345 Record the entry for cash sales and its sales taxes. Nate: Enter debits before credits. of merchandse (costing $10,500 ) for cash . The sales tax rate is 4 On sd fiom the salo to the government old a six-game pack of advance tichets for $630 cash. On November 20 . ngame pack (this represented one-sich of the advance ticket salest fects on the occounsing equston-specifically, identify the accounts and amounts Required information The following information applies to the questions displayed below] 1. On July 15, Piper Company sold $21,000 of merchandise (costing $10,500 ) for cash, The sales tax rate is 4%. On August 1, P.per sent the sales tax collected from the sale to the government. 2. On November 3, the Milwaukee Bucks sold a six-game pack of advance tickets for $630 cash, On November 20 . the Bucks played the first game of the six-game pack (this represented one-sixth of the advance ticket soles). 1. Record entries for the July 15 and August 1 transactions. 2. Record the entries for the November 3 and November 20 transactions: 1. On July 15. Piper Company sold $21,000 of merchandise (costing $10,500 ) for cash. The sales tax rate is 4 on August 1, Piper sent the sales tax collected from the sale to the gavernment. 2. On November 3, the Milwatuke Bucks sold a six-game pack of advance tickets for $630 cash On November 20 . the Bucks played the first game of the six-game pack (this represented one-sixth of the advance ticket sales) Chalyze each separate transoction by showing its effects on the accounting equation-spocifically, idontify the accounts and amounts including + or -1 for each transaction. Vote: Enter all amounts as positive values. Journal entry worksheet Record the revenue earned from sale of tickets. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts