Question: Please answer both 6 and 7, I will upvote! QUESTION 6 The term Debt Service is frequently used in real estate analysis (we'll assume an

Please answer both 6 and 7, I will upvote!

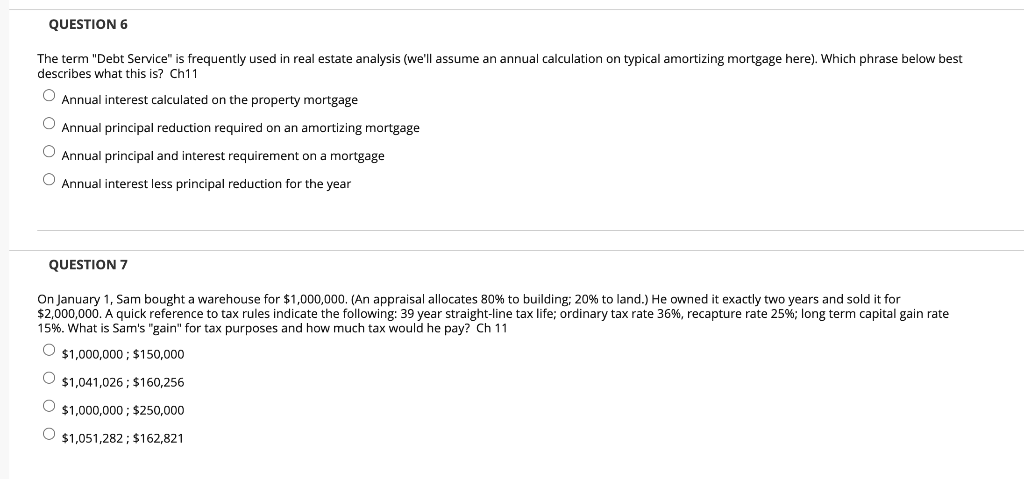

QUESTION 6 The term "Debt Service" is frequently used in real estate analysis (we'll assume an annual calculation on typical amortizing mortgage here). Which phrase below best describes what this is? Ch11 O Annual interest calculated on the property mortgage Annual principal reduction required on an amortizing mortgage Annual principal and interest requirement on a mortgage O Annual interest less principal reduction for the year QUESTION 7 On January 1, Sam bought a warehouse for $1,000,000. (An appraisal allocates 80% to building; 20% to land.) He owned it exactly two years and sold it for $2,000,000. A quick reference to tax rules indicate the following: 39 year straight-line tax life; ordinary tax rate 36%, recapture rate 25%; long term capital gain rate 15%. What is Sam's "gain" for tax purposes and how much tax would he pay? Ch 11 O $1,000,000; $150,000 O $1,041,026; $160,256 $1,000,000; $250,000 O $1,051,282; $162,821

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts