Question: please answer both A trader predicts that there will be great price movements of USD/British Pounds in the near future but does not know which

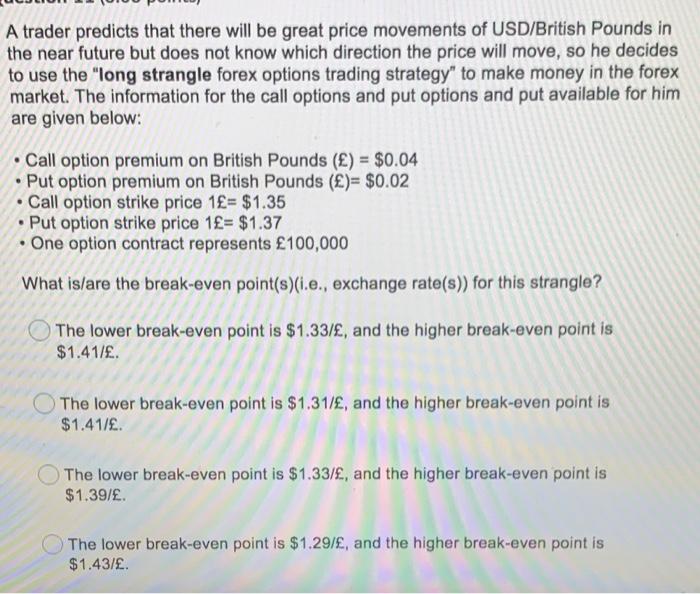

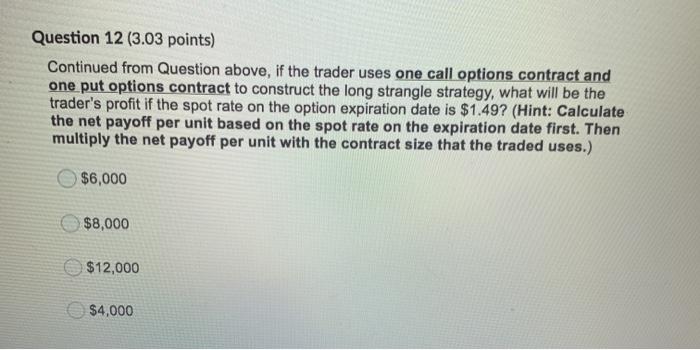

A trader predicts that there will be great price movements of USD/British Pounds in the near future but does not know which direction the price will move, so he decides to use the "long strangle forex options trading strategy" to make money in the forex market. The information for the call options and put options and put available for him are given below: Call option premium on British Pounds () = $0.04 Put option premium on British Pounds ()= $0.02 Call option strike price 1= $1.35 Put option strike price 1= $1.37 One option contract represents 100,000 What is/are the break-even point(s)(i.e., exchange rate(s)) for this strangle? The lower break-even point is $1.33/, and the higher break-even point is $1.41/. The lower break-even point is $1.31/, and the higher break-even point is $1.41/. The lower break-even point is $1.33/, and the higher break-even point is $1.39/. The lower break-even point is $1.29/, and the higher break-even point is $1.43/. Question 12 (3.03 points) Continued from Question above, if the trader uses one call options contract and one put options contract to construct the long strangle strategy, what will be the trader's profit if the spot rate on the option expiration date is $1.49? (Hint: Calculate the net payoff per unit based on the spot rate on the expiration date first. Then multiply the net payoff per unit with the contract size that the traded uses.) $6,000 $8,000 $12,000 $4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts