Question: Please answer both! An option which gives the holder the right to sell a stock at a specified price at some time in the future

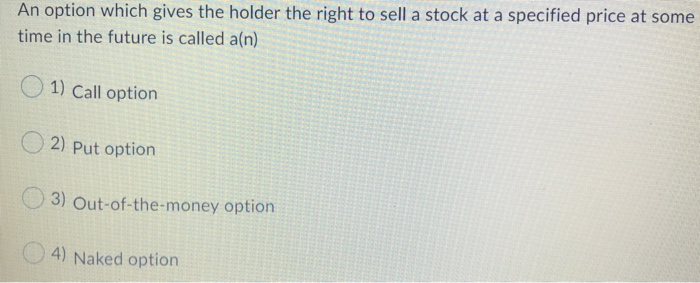

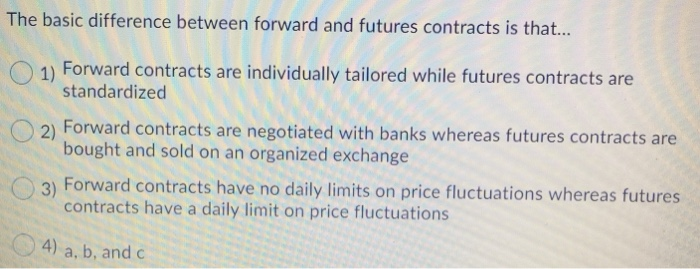

An option which gives the holder the right to sell a stock at a specified price at some time in the future is called a(n) 1) Call option 2) Put option 3) Out-of-the-money option 4) Naked option The basic difference between forward and futures contracts is that... 1) Forward contracts are individually tailored while futures contracts are standardized 2) Forward contracts are negotiated with banks whereas futures contracts are bought and sold on an organized exchange 3) Forward contracts have no daily limits on price fluctuations whereas futures contracts have a daily limit on price fluctuations 4) a, b, and c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts