Question: please answer both and show steps. if possible can you show the step with tmv function for finanical calculator for example FV=100 N= i= Pv=

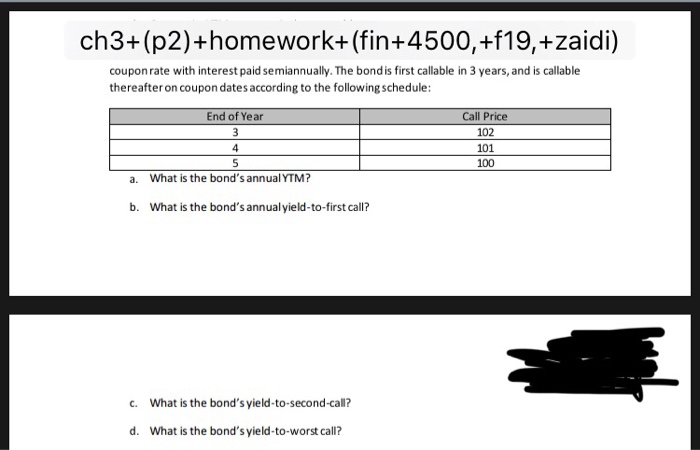

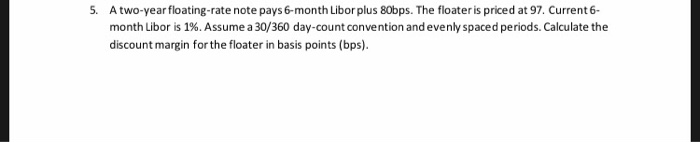

ch3+(p2)+homework+(fin+4500,+f19,+zaidi) coupon rate with interest paid semiannually. The bond is first callable in 3 years, and is callable thereafter on coupon dates according to the following schedule: End of Year Call Price 3 102 4 101 5 100 What is the bond's annualYTM? a. What is the bond's annual yie ld-to-first call? b. What is the bond's yield-to-second-call? C. d. What is the bond's yield -to-worst call? A two-year floating-rate note pays 6-month Libor plus 80bps. The floater is priced at 97. Current 6- 5. month Libor is 1%. Assume a 30/360 day-count convention and evenly spaced periods. Calcu late the discount margin for the floater in basis points (bps)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts