Question: please answer both and show work! Calculate the current price of a $5,000 par value bond that has a coupon rate of 20 percent, pays

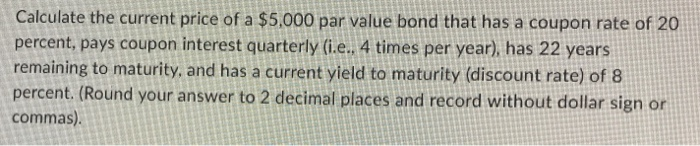

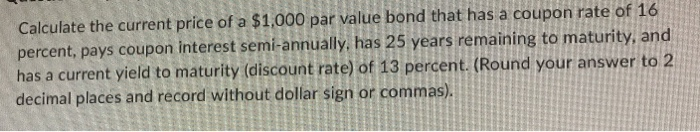

Calculate the current price of a $5,000 par value bond that has a coupon rate of 20 percent, pays coupon interest quarterly (i.e. 4 times per year), has 22 years remaining to maturity, and has a current yield to maturity (discount rate) of 8 percent. (Round your answer to 2 decimal places and record without dollar sign or commas). Calculate the current price of a $1,000 par value bond that has a coupon rate of 16 percent, pays coupon interest semi-annually, has 25 years remaining to maturity, and has a current yield to maturity (discount rate) of 13 percent. (Round your answer to 2 decimal places and record without dollar sign or commas)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts