Question: Please answer both and show work. will leave thumbs up if it is correct A forward rate agreement (FRA) pays 4.6% interest (with semiannual compounded)

Please answer both and show work. will leave thumbs up if it is correct

Please answer both and show work. will leave thumbs up if it is correct

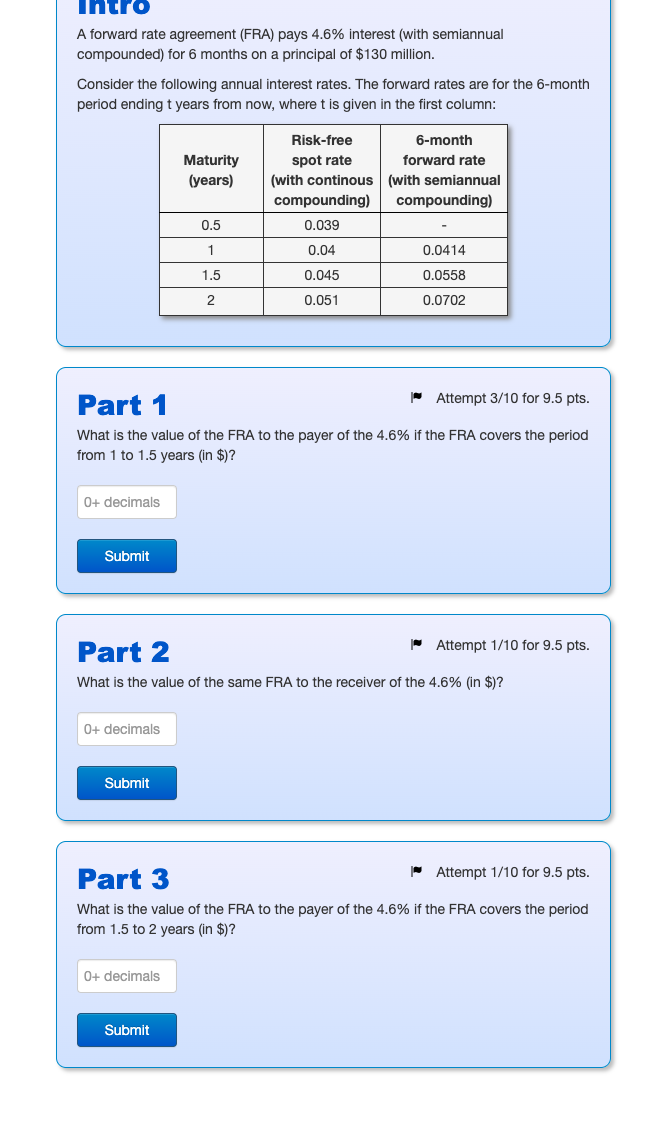

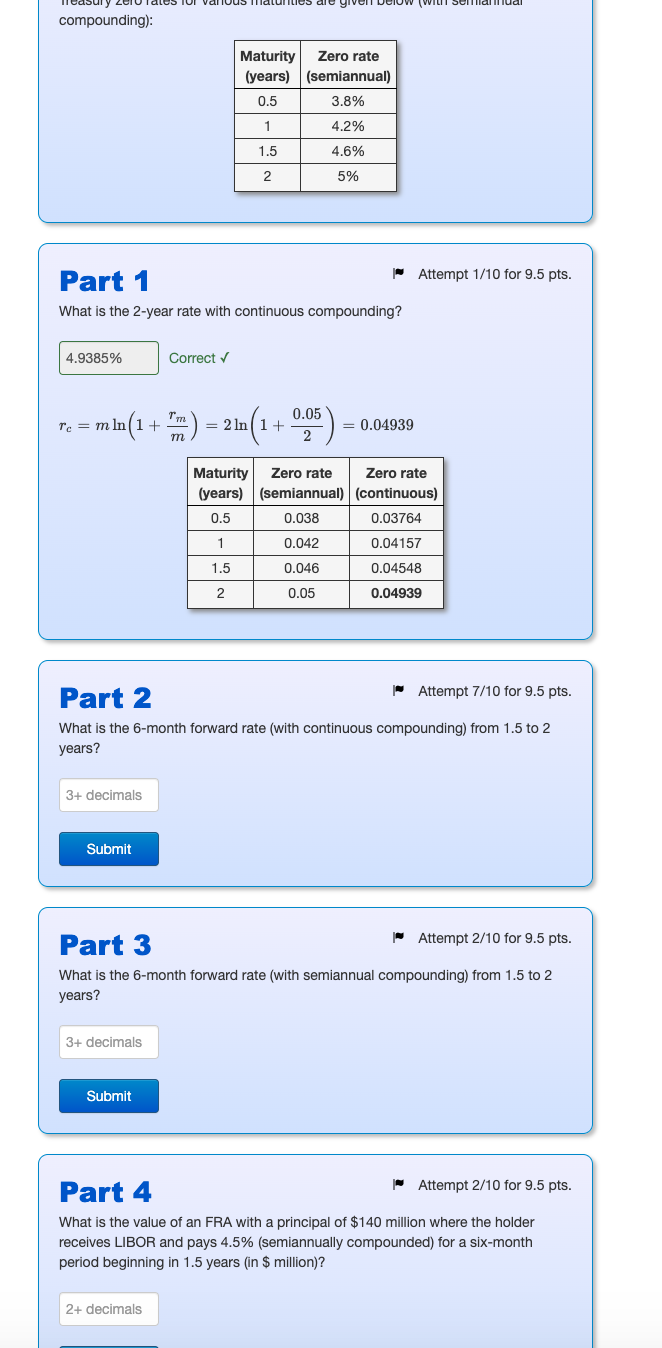

A forward rate agreement (FRA) pays 4.6% interest (with semiannual compounded) for 6 months on a principal of $130 million. Consider the following annual interest rates. The forward rates are for the 6-month period ending t years from now, where t is given in the first column: Maturity (years) Risk-free 6-month spot rate forward rate (with continous (with semiannual compounding) compounding) 0.039 0.5 1 0.04 0.0414 1.5 0.045 0.0558 2 0.051 0.0702 Attempt 3/10 for 9.5 pts. Part 1 What is the value of the FRA to the payer of the 4.6% if the FRA covers the period from 1 to 1.5 years (in $)? 0+ decimals Submit Attempt 1/10 for 9.5 pts. Part 2 What is the value of the same FRA to the receiver of the 4.6% (in $)? 0+ decimals Submit Attempt 1/10 for 9.5 pts. Part 3 What is the value of the FRA to the payer of the 4.6% if the FRA covers the period from 1.5 to 2 years (in $)? 0+ decimals Submit matunities are given compounding): Maturity Zero rate (years) (semiannual) 0.5 3.8% TE 1 4.2% 1.5 4.6% 5% 2 2 Attempt 1/10 for 9.5 pts. Part 1 What is the 2-year rate with continuous compounding? 4.9385% Correct Te = m lr Tc m In n ln(1 + " m) home) = 2ln(1 + = 0.05 2 0.04939 Maturity Zero rate Zero rate (years) (semiannual) (continuous) 0.5 0.038 0.03764 1 0.042 0.04157 1.5 0.046 0.04548 2 0.05 0.04939 Attempt 7/10 for 9.5 pts. Part 2 What is the 6-month forward rate with continuous compounding) from 1.5 to 2 years? 3+ decimals Submit Part 3 Attempt 2/10 for 9.5 pts. What is the 6-month forward rate with semiannual compounding) from 1.5 to 2 years? 3+ decimals Submit Part 4 | Attempt 2/10 for 9.5 pts. What is the value of an FRA with a principal of $140 million where the holder receives LIBOR and pays 4.5% (semiannually compounded) for a six-month period beginning in 1.5 years (in $ million)? 2+ decimals A forward rate agreement (FRA) pays 4.6% interest (with semiannual compounded) for 6 months on a principal of $130 million. Consider the following annual interest rates. The forward rates are for the 6-month period ending t years from now, where t is given in the first column: Maturity (years) Risk-free 6-month spot rate forward rate (with continous (with semiannual compounding) compounding) 0.039 0.5 1 0.04 0.0414 1.5 0.045 0.0558 2 0.051 0.0702 Attempt 3/10 for 9.5 pts. Part 1 What is the value of the FRA to the payer of the 4.6% if the FRA covers the period from 1 to 1.5 years (in $)? 0+ decimals Submit Attempt 1/10 for 9.5 pts. Part 2 What is the value of the same FRA to the receiver of the 4.6% (in $)? 0+ decimals Submit Attempt 1/10 for 9.5 pts. Part 3 What is the value of the FRA to the payer of the 4.6% if the FRA covers the period from 1.5 to 2 years (in $)? 0+ decimals Submit matunities are given compounding): Maturity Zero rate (years) (semiannual) 0.5 3.8% TE 1 4.2% 1.5 4.6% 5% 2 2 Attempt 1/10 for 9.5 pts. Part 1 What is the 2-year rate with continuous compounding? 4.9385% Correct Te = m lr Tc m In n ln(1 + " m) home) = 2ln(1 + = 0.05 2 0.04939 Maturity Zero rate Zero rate (years) (semiannual) (continuous) 0.5 0.038 0.03764 1 0.042 0.04157 1.5 0.046 0.04548 2 0.05 0.04939 Attempt 7/10 for 9.5 pts. Part 2 What is the 6-month forward rate with continuous compounding) from 1.5 to 2 years? 3+ decimals Submit Part 3 Attempt 2/10 for 9.5 pts. What is the 6-month forward rate with semiannual compounding) from 1.5 to 2 years? 3+ decimals Submit Part 4 | Attempt 2/10 for 9.5 pts. What is the value of an FRA with a principal of $140 million where the holder receives LIBOR and pays 4.5% (semiannually compounded) for a six-month period beginning in 1.5 years (in $ million)? 2+ decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts