Question: Please answer both and show work/provide excel calculations. Dent industries has produced a new mountain bike prototype and is ready to go ahead with pilot

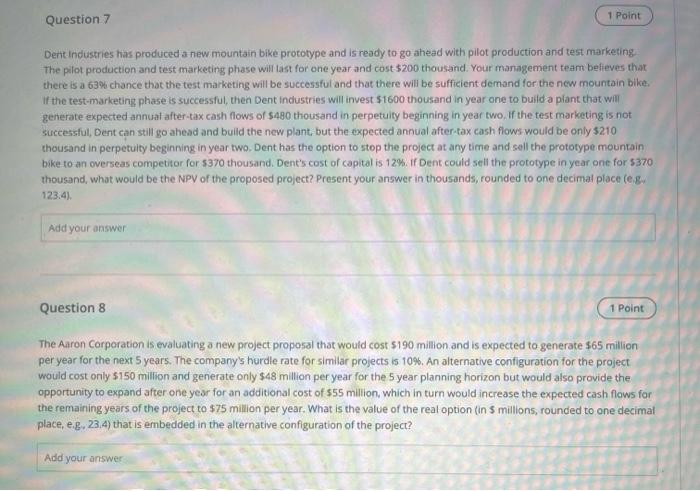

Dent industries has produced a new mountain bike prototype and is ready to go ahead with pilot production and test marketing The pilot production and test marketing phase will last for one year and cost $200 thousand. Your management team befieves that there is a 63% chance that the test marketing will be successful and that there will be sufficient demand for the new mountain bike. If the test-marketing phase is successful, then Dent industries will invest $1600 thousand in year one to build a piant that will generate expected annual after-tax cash flows of $480 thousand in perpetuity beginning in year two. If the test marketing is not successful, Dent can still go ahead and build the new plant, but the expected annual after-tax cash flows would be only $210 thousand in perpetuity beginning in year two. Dent has the option to stop the project at any time and sell the prototype mountain bike to an overseas competitor for $370 thousand. Dent's cost of capital is 12%. If Dent could sell the prototype in year one for $370 thousand, what would be the NPV of the proposed project? Present your answer in thousands, rounded to one decimal place (e g. 123.4). Add your answer Question 8 The Aaron Corporation is evaluating a new project proposal that would cost $190 million and is expected to generate $65 million per year for the next 5 years. The company's hurdle rate for similar projects is 10%. An alternative configuration for the project would cost only $150 million and generate only $48 million per year for the 5 year planning horizon but would also provide the opportunity to expand after one year for an additional cost of $55 million, which in turn would increase the expected cash flows for the remaining years of the project to $75 million per year. What is the value of the real option (in 5 millions, rounded to one decimal place, e.g. 23.4) that is embedded in the alternative configuration of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts