Question: please answer both asap A company has 10 year bond outstanding with a BBB rating and the bond is currently selling at par. The bond

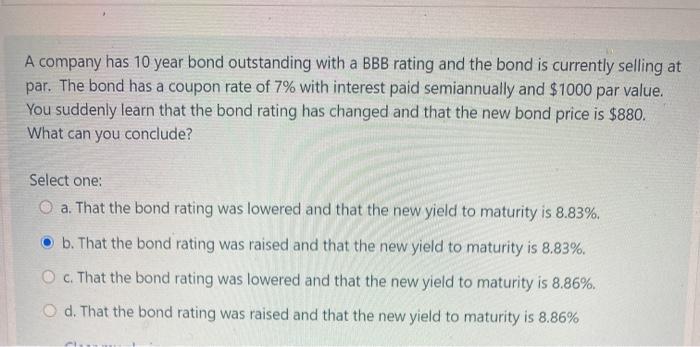

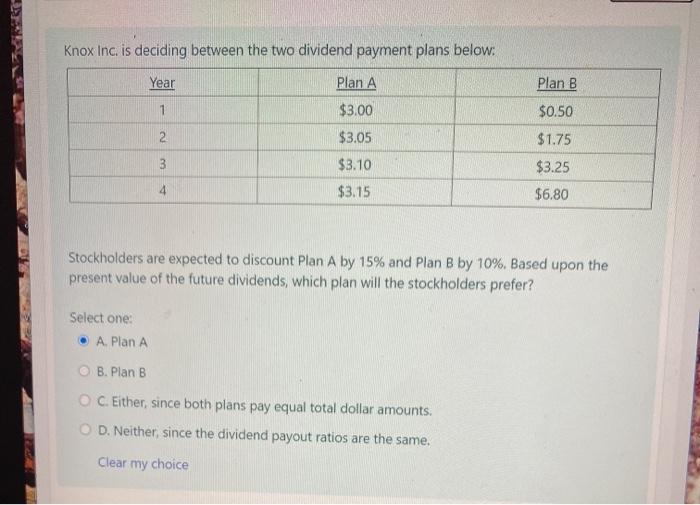

A company has 10 year bond outstanding with a BBB rating and the bond is currently selling at par. The bond has a coupon rate of 7% with interest paid semiannually and $1000 par value. You suddenly learn that the bond rating has changed and that the new bond price is $880. What can you conclude? Select one: O a. That the bond rating was lowered and that the new yield to maturity is 8.83%, b. That the bond rating was raised and that the new yield to maturity is 8.83%. O c. That the bond rating was lowered and that the new yield to maturity is 8.86%. O d. That the bond rating was raised and that the new yield to maturity is 8.86% Knox Inc. is deciding between the two dividend payment plans below: Year Plan A Plan B 1 $3.00 $0.50 2 $3.05 3 $3.10 $1.75 $3.25 $6.80 4 $3.15 Stockholders are expected to discount Plan A by 15% and Plan B by 10%. Based upon the present value of the future dividends, which plan will the stockholders prefer? Select one: A. Plan A B. Plan B C. Either, since both plans pay equal total dollar amounts. OD. Neither, since the dividend payout ratios are the same. Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts