Question: please answer both asap Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. This year, she sells the following long-term assets

please answer both asap

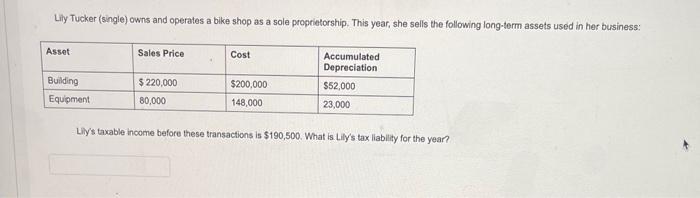

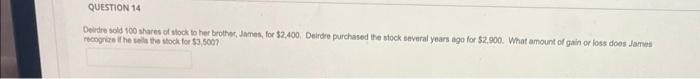

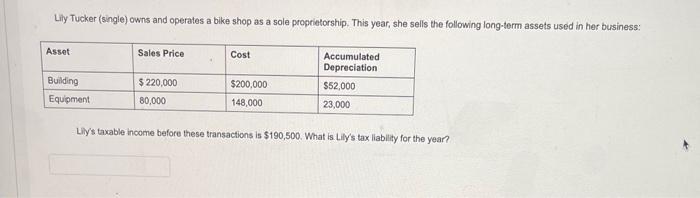

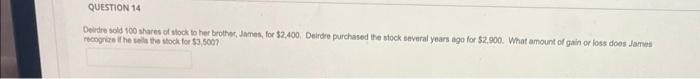

Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. This year, she sells the following long-term assets used in her business: Lily's taxable income before these transactions is $190,500. What is Lily's tax liablity for the year? Deidre sold 100 shares of tiock to her brother, James, for $2,400. Deirdre purchased the siock eaveral years ago for $2,900. What amount of gain or loss does Jamet rectorize if he taila the thock for 53,509

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock