Question: Please answer both Both are different questions 4. It has been estimated that equipment bought for $24 000 will have a use ful life of

Please answer both

Both are different questions

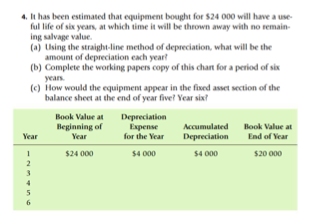

4. It has been estimated that equipment bought for $24 000 will have a use ful life of six years, at which time it will be thrown away with no remain ing alage value (a) Using the straight-line method of depreciation, what will be the amount of depreciation each year! (6) Complete the working papers copy of this chart for a period of six years (c) How would the equipment appear in the fixed asset section of the balance sheet at the end of year five? Year six? Book Value at Depreciation Beginning of Expense Accumulated Book Value at Year Year for the Year Depreciation End of Year 1 1 $24 000 $4.000 $4000 $20 000 2 3 4 5 6 6. Newson Electric prepares monthly financial statements. Fixed assets owned by the company include equipment valued at $14000 and a service van worth $30 000. Accumulated depreciation on the equipment is $7170 Accumulated depreciation on the truck is 56500. Prepare adjusting entries to record one month's depreciation, using the declining balance method. The rate of depreciation for one year for the equipment is 20 percent, and for the truck is 30 percent. (Hint: You may need to round any calculations to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts