Question: please answer both clearly This year Sooner Company reports current E&P of negative $300,000. Its accumulated E&P at the beginning of the year was $195,000.

please answer both clearly

please answer both clearly

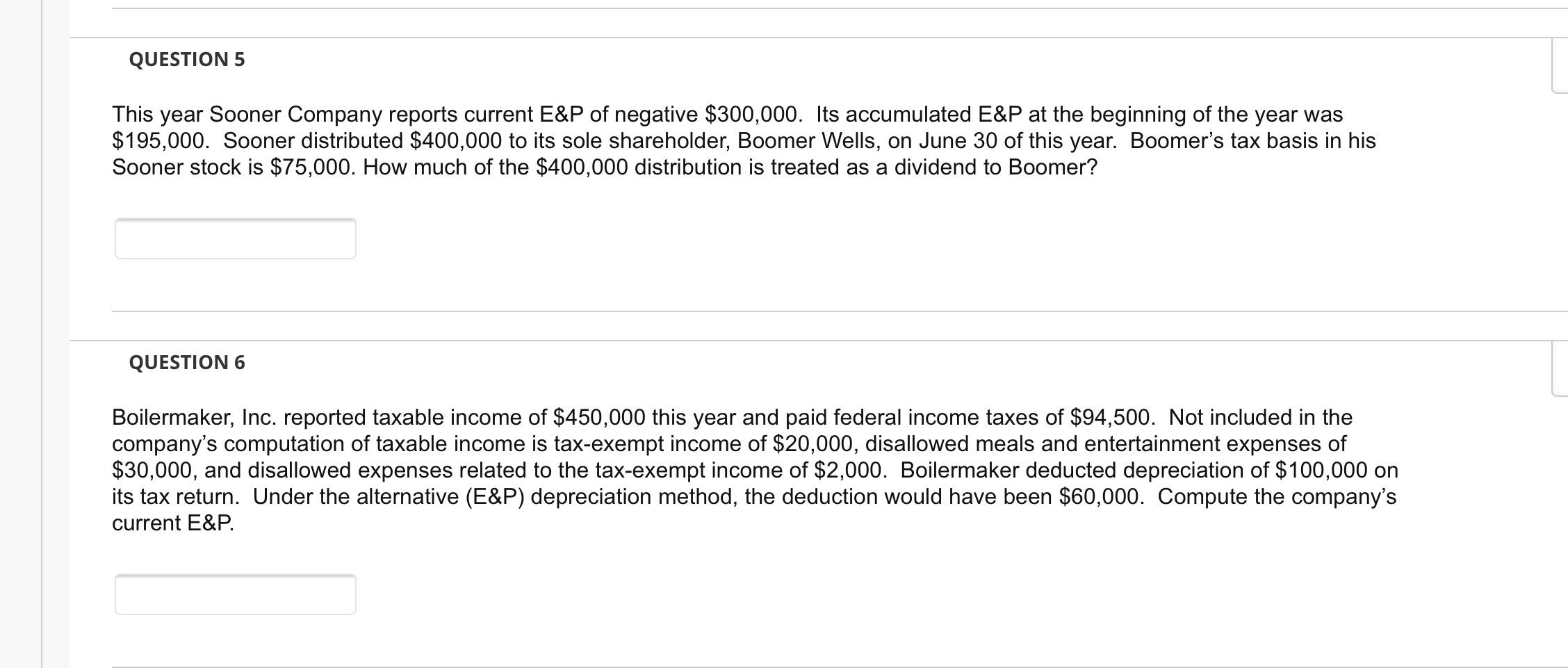

This year Sooner Company reports current E\&P of negative $300,000. Its accumulated E\&P at the beginning of the year was $195,000. Sooner distributed $400,000 to its sole shareholder, Boomer Wells, on June 30 of this year. Boomer's tax basis in his Sooner stock is $75,000. How much of the $400,000 distribution is treated as a dividend to Boomer? QUESTION 6 Boilermaker, Inc. reported taxable income of $450,000 this year and paid federal income taxes of $94,500. Not included in the company's computation of taxable income is tax-exempt income of $20,000, disallowed meals and entertainment expenses of $30,000, and disallowed expenses related to the tax-exempt income of $2,000. Boilermaker deducted depreciation of $100,000 on its tax return. Under the alternative (E\&P) depreciation method, the deduction would have been $60,000. Compute the company's current E\&P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts