Question: Please answer both. Computing Depreciation and Accounting for a Change of Estimate In January 2019, Rankine Company paid $8,500,000 for land and a building. An

Please answer both.

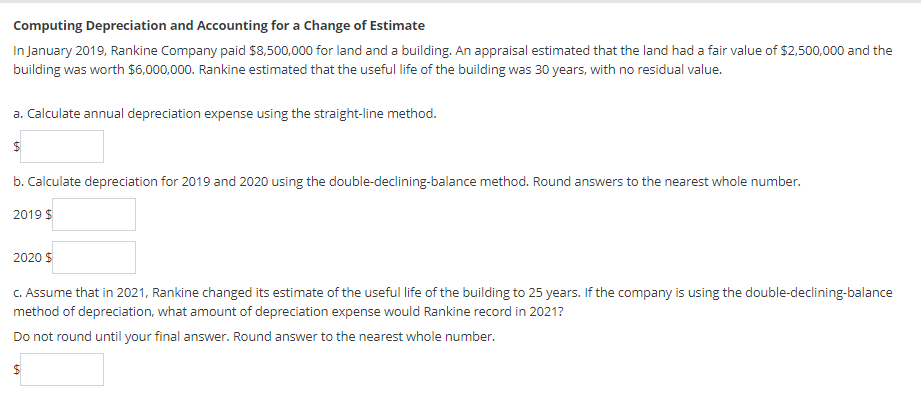

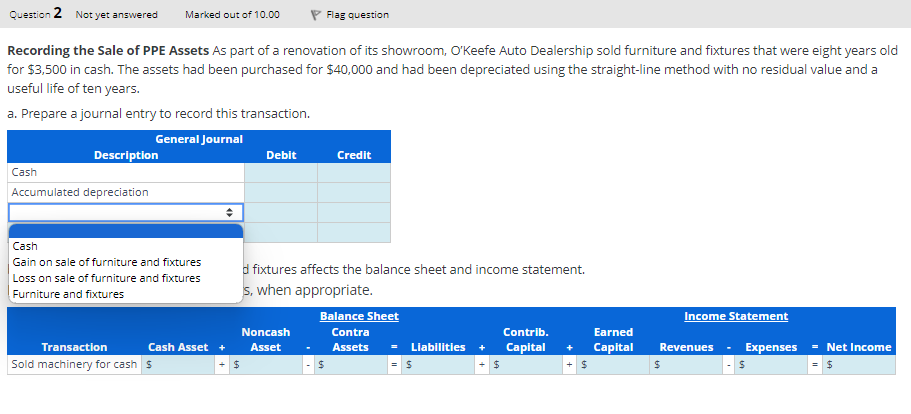

Computing Depreciation and Accounting for a Change of Estimate In January 2019, Rankine Company paid $8,500,000 for land and a building. An appraisal estimated that the land had a fair value of $2,500,000 and the building was worth $6,000,000. Rankine estimated that the useful life of the building was 30 years, with no residual value. a. Calculate annual depreciation expense using the straight-line method. $ b. Calculate depreciation for 2019 and 2020 using the double-declining-balance method. Round answers to the nearest whole number. 2019 2020$ c. Assume that in 2021, Rankine changed its estimate of the useful life of the building to 25 years. If the company is using the double-declining-balance method of depreciation, what amount of depreciation expense would Rankine record in 2021 ? Do not round until your final answer. Round answer to the nearest whole number. $ Recording the Sale of PPE Assets As part of a renovation of its showroom, O'Keefe Auto Dealership sold furniture and fixtures that were eight years old for $3,500 in cash. The assets had been purchased for $40,000 and had been depreciated using the straight-line method with no residual value and a useful life of ten years. a. Prepare a journal entry to record this transaction. Ice sheet and income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts