Question: please answer both Current Attempt in Progress Partners Gary and Elaine have agreed to share profits and losses in an 90:10 ratio respectively, after Gary

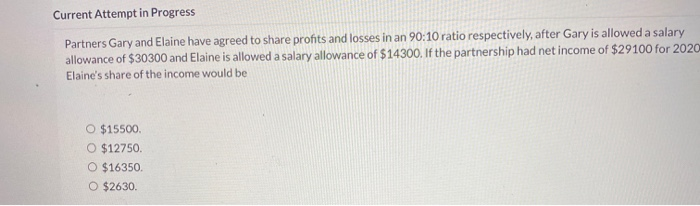

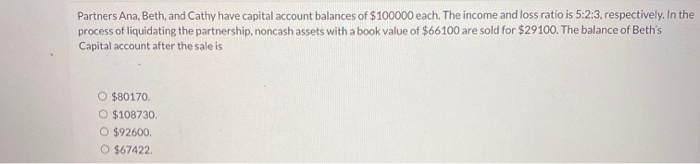

Current Attempt in Progress Partners Gary and Elaine have agreed to share profits and losses in an 90:10 ratio respectively, after Gary is allowed a salary allowance of $30300 and Elaine is allowed a salary allowance of $14300. If the partnership had net income of $29100 for 2020 Elaine's share of the income would be O $15500. O $12750 O $16350 O $2630. Partners Ana, Beth, and Cathy have capital account balances of $100000 each. The income and loss ratio is 5:2:3, respectively. In the process of liquidating the partnership, noncash assets with a book value of $66100 are sold for $29100. The balance of Beth's Capital account after the sale is O $80170 O $108730. O $92600 O $67422

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts