Question: please answer both D Question 7 1 pts The excess return is computed as Orisk-free rate minus the inflation rate. O risk-free rate plus the

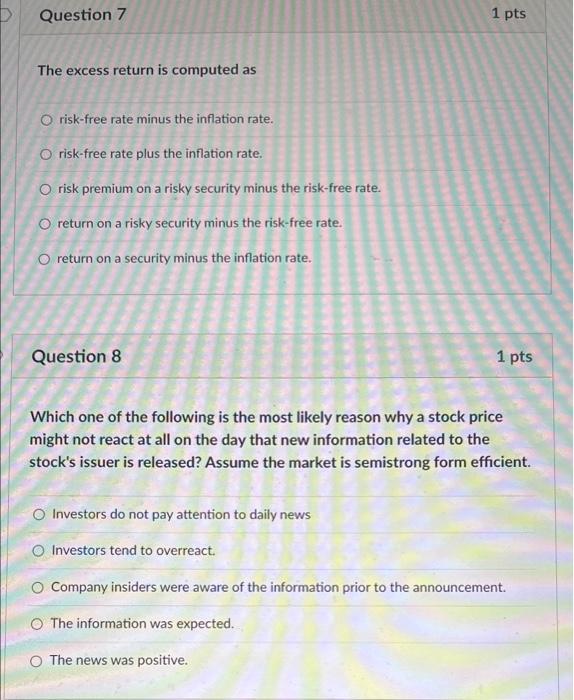

D Question 7 1 pts The excess return is computed as Orisk-free rate minus the inflation rate. O risk-free rate plus the inflation rate. Orisk premium on a risky security minus the risk-free rate. O return on a risky security minus the risk-free rate. O return on a security minus the inflation rate. Question 8 1 pts Which one of the following is the most likely reason why a stock price might not react at all on the day that new information related to the stock's issuer is released? Assume the market is semistrong form efficient. O Investors do not pay attention to daily news O Investors tend to overreact. O Company insiders were aware of the information prior to the announcement. The information was expected. The news was positive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts