Question: please answer both F&G for me (f) You are given the following three European derivatives on a stock worth $100 now and with a volatility

please answer both F&G for me

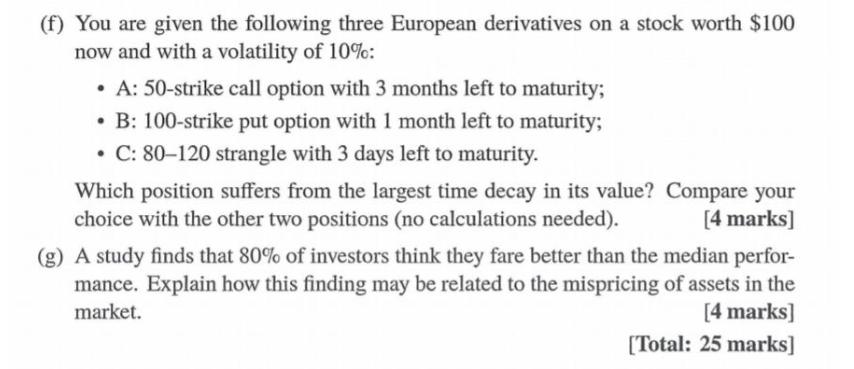

(f) You are given the following three European derivatives on a stock worth $100 now and with a volatility of 10%: A: 50-strike call option with 3 months left to maturity; B: 100-strike put option with 1 month left to maturity; C: 80-120 strangle with 3 days left to maturity. Which position suffers from the largest time decay in its value? Compare your choice with the other two positions (no calculations needed). [4 marks] (g) A study finds that 80% of investors think they fare better than the median perfor- mance. Explain how this finding may be related to the mispricing of assets in the market. [4 marks] [Total: 25 marks] (f) You are given the following three European derivatives on a stock worth $100 now and with a volatility of 10%: A: 50-strike call option with 3 months left to maturity; B: 100-strike put option with 1 month left to maturity; C: 80-120 strangle with 3 days left to maturity. Which position suffers from the largest time decay in its value? Compare your choice with the other two positions (no calculations needed). [4 marks] (g) A study finds that 80% of investors think they fare better than the median perfor- mance. Explain how this finding may be related to the mispricing of assets in the market. [4 marks] [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts