Question: please answer both for a thumbs up The following data are given for Stringer Company: Budgeted production 973 units Actual production 1,057 units Materials: Standard

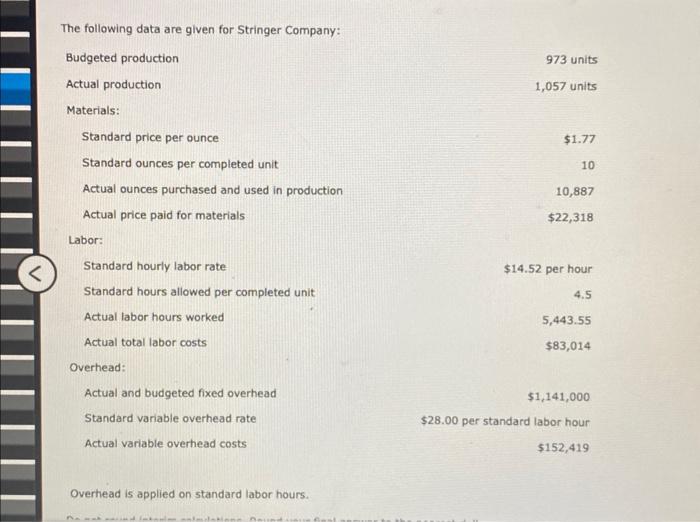

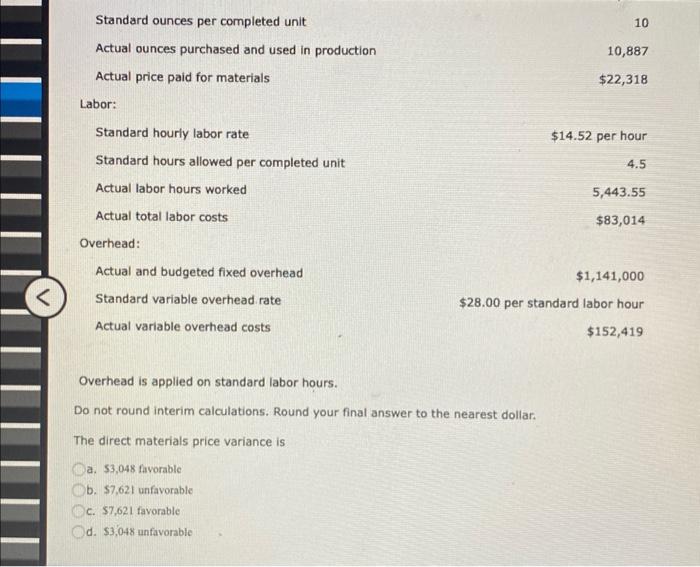

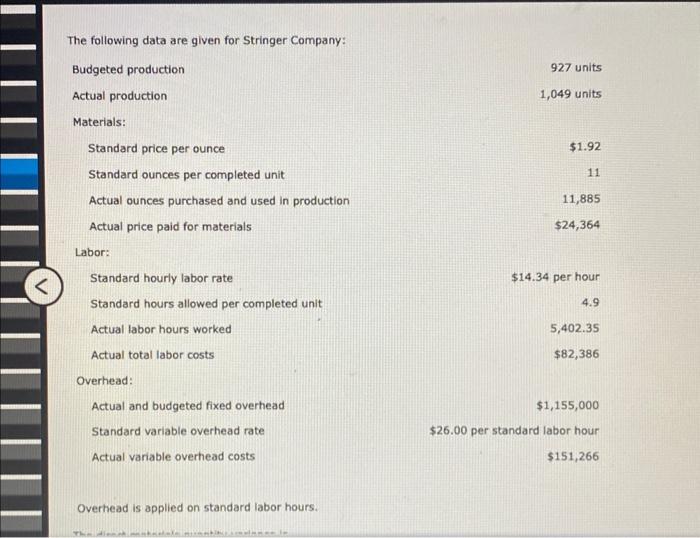

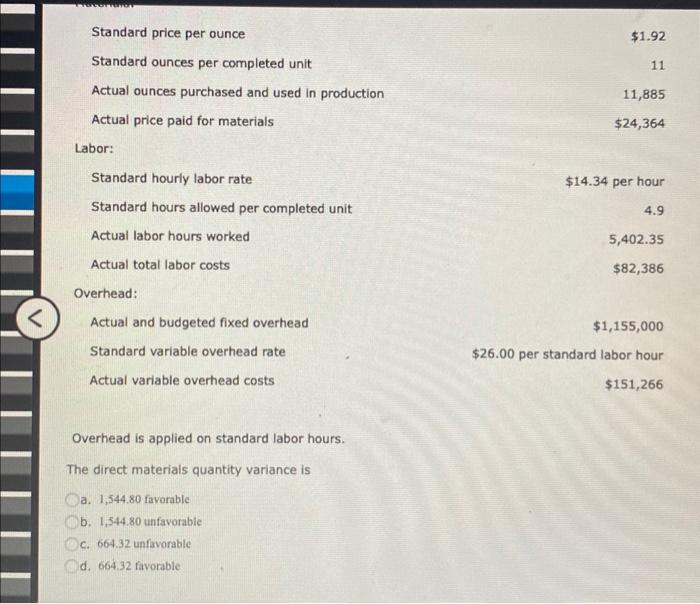

The following data are given for Stringer Company: Budgeted production 973 units Actual production 1,057 units Materials: Standard price per ounce $1.77 Standard ounces per completed unit Actual ounces purchased and used in production Actual price paid for materials $22,318 Labor: Standard hourly labor rate $14.52 per hour Standard hours allowed per completed unit Actual labor hours worked Actual total labor costs Overhead: Actual and budgeted fixed overhead $1,141,000 Standard variable overhead rate $28.00 per standard labor hour Actual variable overhead costs $152,419 Overhead is applied on standard labor hours. Overhead is applied on standard labor hours. Do not round interim calculations. Round your final answer to the nearest dollar: The direct materials price variance is a. 53,048 favorable b. $7,621 unfavorable c. $7,621 favorable d. $3,048 unfavorable The following data are given for Stringer Company: Budgeted production 927 units Actual production 1,049 units Materials: Standard price per ounce $1.92 Standard ounces per completed unit 11 Actual ounces purchased and used in production 11,885 Actual price paid for materials $24,364 Labor: Standard hourly labor rate $14.34 per hour Standard hours allowed per completed unit 4.9 Actual labor hours worked 5,402.35 Actual total labor costs $82,386 Overhead: Actual and budgeted fixed overhead $1,155,000 Standard variable overhead rate $26.00 per standard labor hour Actual variable overhead costs $151,266 Overhead is applied on standard labor hours. Overhead is applied on standard labor hours. The direct materials quantity variance is a. 1,544.80 favorable b. 1,544.80 unfavorable C. 664.32 unfavorable d. 664.32 favorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts