Question: please answer both . I will upvote , thanks You want to go to Europe 5 years from now, and you can save $8,700 per

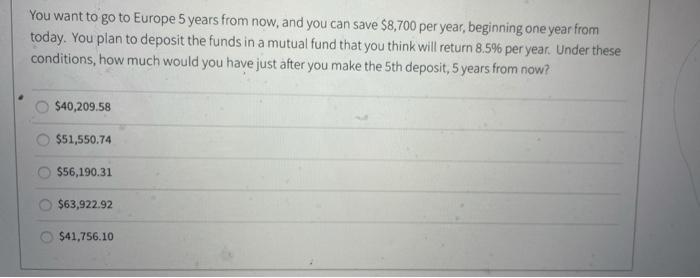

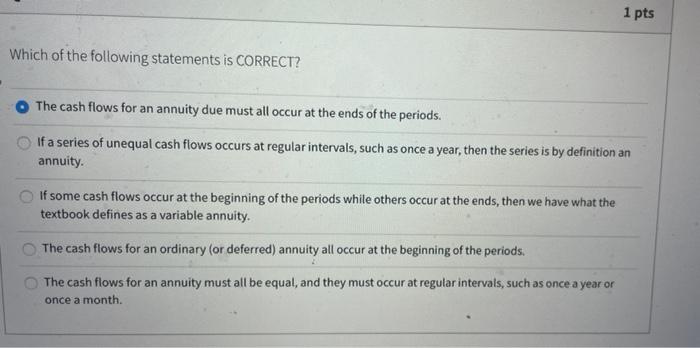

You want to go to Europe 5 years from now, and you can save $8,700 per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think will return 8.5% per year. Under these conditions, how much would you have just after you make the 5th deposit, 5 years from now? $40,209.58 $51,550.74 $56,190.31 $63,922.92 $41,756.10 1 pts Which of the following statements is CORRECT? The cash flows for an annuity due must all occur at the ends of the periods. If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity. The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods. The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts