Question: Please answer both if possible! (Please write out correct answer and whether it's A,B,C or D). The IRR function in Microsoft Excel was used to

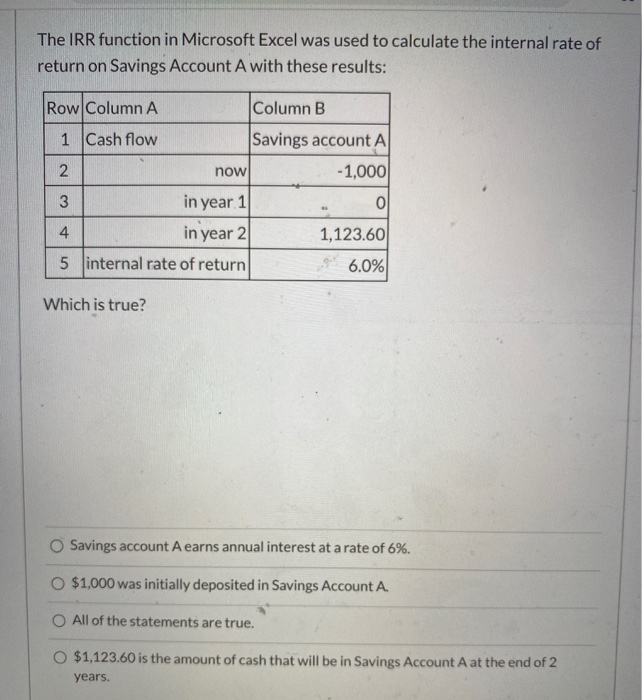

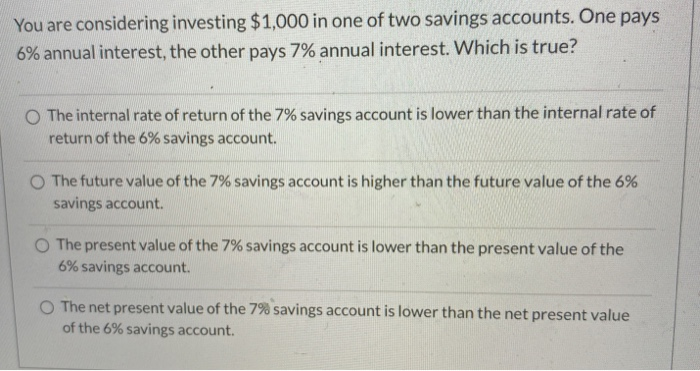

The IRR function in Microsoft Excel was used to calculate the internal rate of return on Savings Account A with these results: Row Column A Column B now 1 Cash flow Savings account A 2 - 1,000 3 in year 1 0 4 in year 2 1,123.60 5 internal rate of freturn 6.0% Which is true? O Savings account A earns annual interest at a rate of 6%. O $1,000 was initially deposited in Savings Account A. O All of the statements are true. O $1,123.60 is the amount of cash that will be in Savings Account A at the end of 2 years. You are considering investing $1,000 in one of two savings accounts. One pays 6% annual interest, the other pays 7% annual interest. Which is true? The internal rate of return of the 7% savings account is lower than the internal rate of return of the 6% savings account. The future value of the 7% savings account is higher than the future value of the 6% savings account The present value of the 7% savings account is lower than the present value of the 6% savings account. The net present value of the 7% savings account is lower than the net present value of the 6% savings account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts