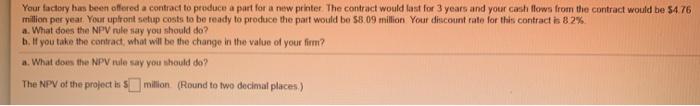

Question: Please answer both letters. Your factory has been offered a contract to produce a part for a new printer The contract would last for 3

Your factory has been offered a contract to produce a part for a new printer The contract would last for 3 years and your cash flows from the contract would be 54.76 million per year Your uplront setup costs to be ready to produce the part would be 58.09 million your discount rate for this contract is 82% a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is million (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts