Question: please answer both or i will down vote 2 pts D Question 28 Scott, age 35, is single and will earn $68,000 in 2021. He

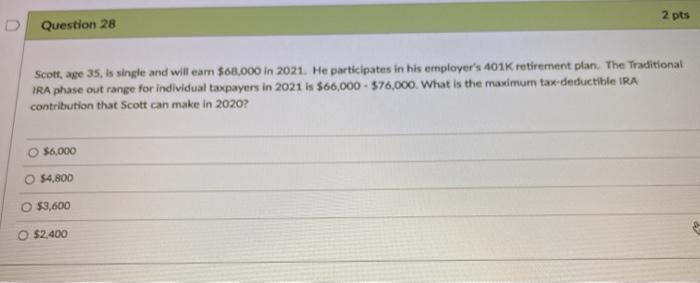

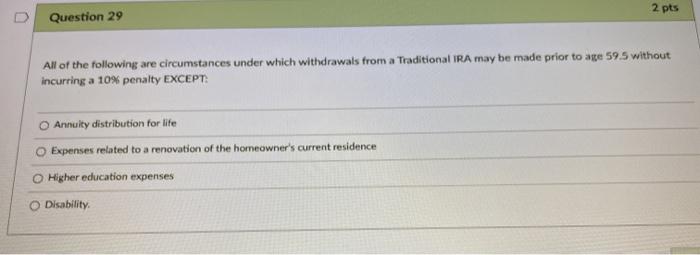

2 pts D Question 28 Scott, age 35, is single and will earn $68,000 in 2021. He participates in his employer's 401K retirement plan. The Traditional IRA phase out range for individual taxpayers in 2021 is $66,000 - $76,000. What is the maximum tax deductible IRA contribution that Scott can make in 2020? $6,000 O $4,800 O $3,600 O $2,400 2 pts Question 29 All of the following are circumstances under which withdrawals from a Traditional IRA may be made prior to age 595 without incurring a 10% penalty EXCEPT: Annuity distribution for life Expenses related to a renovation of the homeowner's current residence Higher education expenses O Disability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts