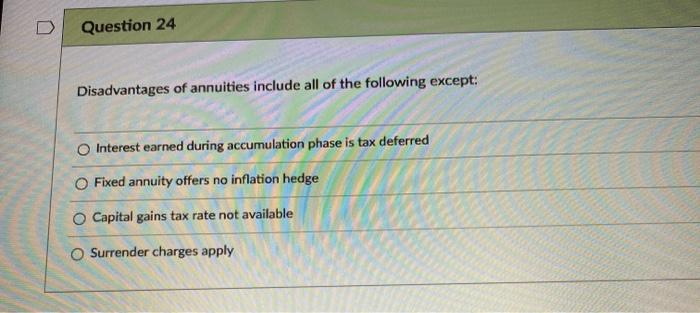

Question: please answer both or i will down vote D Question 24 Disadvantages of annuities include all of the following except: Interest earned during accumulation phase

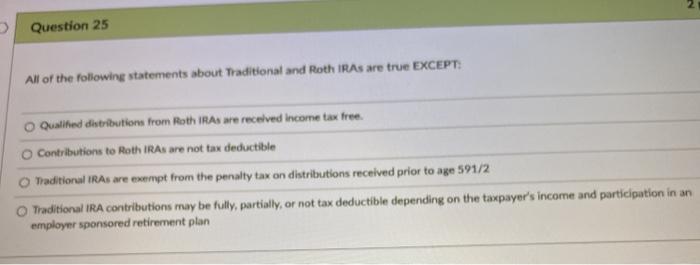

D Question 24 Disadvantages of annuities include all of the following except: Interest earned during accumulation phase is tax deferred Fixed annuity offers no inflation hedge Capital gains tax rate not available O Surrender charges apply 2 >> Question 25 All of the following statements about Traditional and Roth IRAs are true EXCEPT: Qualified distributions from Roth IRAs we received income tax free Contributions to Roth IRAs are not tax deductible Traditional IRAs are exempt from the penalty tax on distributions received prior to age 591/2 Traditional IRA contributions may be fully, partially, or not tax deductible depending on the taxpayer's income and participation in an employer sponsored retirement plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts