Question: please answer both part a & b thank you! Ridley Custom Metal Products (RCMP) must purchase a new tube bender. RCMP'S MARR is 14 percent.

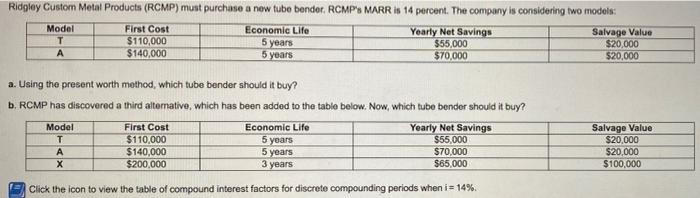

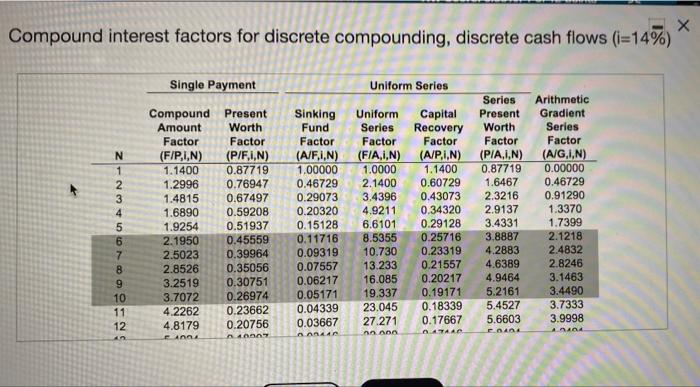

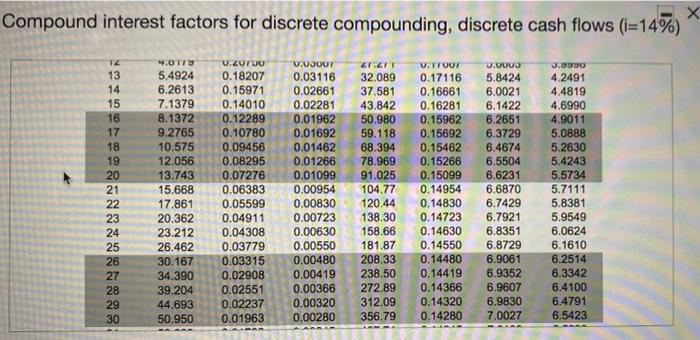

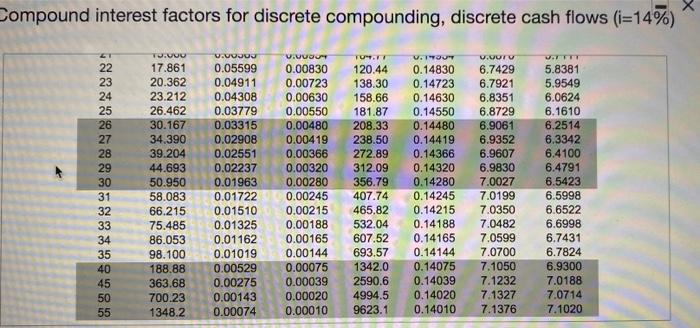

Ridley Custom Metal Products (RCMP) must purchase a new tube bender. RCMP'S MARR is 14 percent. The company is considering two models: Model First Cost Economic Life Yearty Net Savings Salvage Value $110,000 5 years $55,000 $20.000 A $140,000 5 years $70,000 $20,000 a. Using the present worth method, which tube bender should it buy? b. RCMP has discovered a third alterative, which has been added to the table below. Now, which tube bender should it buy? Model T A First Cost $110,000 $140,000 $200,000 Economic Life 5 years 5 years 3 years Yearly Net Savings $55,000 $70,000 $65,000 Salvage Value $20,000 $20,000 $100,000 Click the icon to view the table of compound interest factors for discrete compounding periods when i = 14%. Compound interest factors for discrete compounding, discrete cash flows (i=14%) Single Payment 2 Soon AWN Z Compound Present Amount Worth Factor Factor (F/P.I,N) (P/F.I.N) 1.1400 0.87719 1.2996 0.76947 1.4815 0.67497 1.6890 0.59208 1.9254 0.51937 2.1950 0.45559 2.5023 0.39964 2.8526 0.35056 3.2519 0.30751 3.7072 0.26974 4.2262 0.23662 4.8179 0.20756 FANA Sinking Fund Factor (A/F,1,N) 1.00000 0.46729 0.29073 0.20320 0.15128 0.11716 0.09319 0.07557 0.06217 0.05171 0.04339 0.03667 Ann Uniform Series Uniform Capital Series Recovery Factor Factor (F/A,1,N) (A/P.I,N) 1.0000 1.1400 2.1400 0.60729 3.4396 0.43073 4.9211 0.34320 6.6101 0.29128 8.5355 0.25716 10.730 0.23319 13.233 0.21557 16.085 0.20217 19.337 0.19171 23.045 0.18339 27.271 0.17667 Series Arithmetic Present Gradient Worth Series Factor Factor (PIA.I.N) (AG,1,N) 0.87719 0.00000 1.6467 0.46729 2.3216 0.91290 2.9137 1.3370 3.4331 1.7399 3.8887 2.1218 4.2883 2.4832 4.6389 2.8246 4.9464 3.1463 5.2161 3.4490 5.4527 3.7333 5.6603 3.9998 PADA 10 11 12 AAAA ATAA Compound interest factors for discrete compounding, discrete cash flows (i=14%) .3 TZ 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 YOTI 5.4924 6.2613 7.1379 8.1372 9.2765 10.575 12.056 13.743 15.668 17.861 20.362 23.212 26.462 30.167 34.390 39.204 44.693 50.950 Uzuru 0.18207 0.15971 0.14010 0.12289 0.10780 0.09456 0.08295 0.07276 0.06383 0.05599 0.04911 0.04308 0.03779 0.03315 0.02908 0.02551 0.02237 0.01963 V.UJUUT 0.03116 0.02661 0.02281 0.01962 0.01692 0.01462 0.01266 0.01099 0.00954 0.00830 0.00723 0.00630 0.00550 0.00480 0.00419 0.00366 0.00320 0.00280 27 32.089 37.581 43.842 50.980 59.118 68.394 78.969 91.025 104.77 120.44 138.30 158.66 181.87 208.33 238.50 272.89 312.09 356.79 UTTUU 0.17116 0.16661 0.16281 0.15962 0.15692 0.15462 0.15266 0.15099 0.14954 0.14830 0.14723 0.14630 0.14550 0.14480 0.14419 0.14366 0.14320 0.14280 UUDUS 5.8424 6.0021 6.1422 6.2651 6.3729 6.4674 6.5504 6.6231 6.6870 6.7429 6.7921 6.8351 6.8729 6.9061 6.9352 6.9607 6.9830 7.0027 4.2491 4.4819 4.6990 4.9011 5.0888 5.2630 5.4243 5.5734 5.7111 5.8381 5.9549 6.0624 6.1610 6.2514 6.3342 6.4100 6.4791 6.5423 Compound interest factors for discrete compounding, discrete cash flows (i=14%) 22 23 24 25 26 27 28 29 30 31 32 33 34 35 40 45 50 55 TU.VU 17.861 20.362 23.212 26.462 30.167 34.390 39.204 44.693 50.950 58.083 66.215 75.485 86.053 98.100 188.88 363.68 700.23 1348.2 V.VOJOJ 0.05599 0.04911 0.04308 0.03779 0.03315 0.02908 0.02551 0.02237 0.01963 0.01722 0.01510 0.01325 0.01162 0.01019 0.00529 0.00275 0.00143 0.00074 V.VN 0.00830 0.00723 0.00630 0.00550 0.00480 0.00419 0.00366 0.00320 0.00280 0.00245 0.00215 0.00188 0.00165 0.00144 0.00075 0.00039 0.00020 0.00010 TUT. 120.44 138.30 158.66 181.87 208.33 238.50 272.89 312.09 356.79 407.74 465.82 532.04 607.52 693.57 1342.0 2590.6 4994.5 9623.1 W.YOUTY 0.14830 0.14723 0.14630 0.14550 0.14480 0.14419 0.14366 0.14320 0.14280 0.14245 0.14215 0.14188 0.14165 0.14144 0.14075 0.14039 0.14020 0.14010 v.vuru 6.7429 6.7921 6.8351 6.8729 6.9061 6.9352 6.9607 6.9830 7.0027 7.0199 7.0350 7.0482 7.0599 7.0700 7.1050 7.1232 7.1327 7.1376 5.8381 5.9549 6.0624 6.1610 6.2514 6.3342 6.4100 6.4791 6.5423 6.5998 6.6522 6.6998 6.7431 6.7824 6.9300 7.0188 7.0714 7.1020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts