Question: Please answer both parts and show work. :) Precision Tool 2009 Income Statement $36,408 28,225 1760 6,423 Net sales Less: Cost of goods sold Less:

Please answer both parts and show work. :)

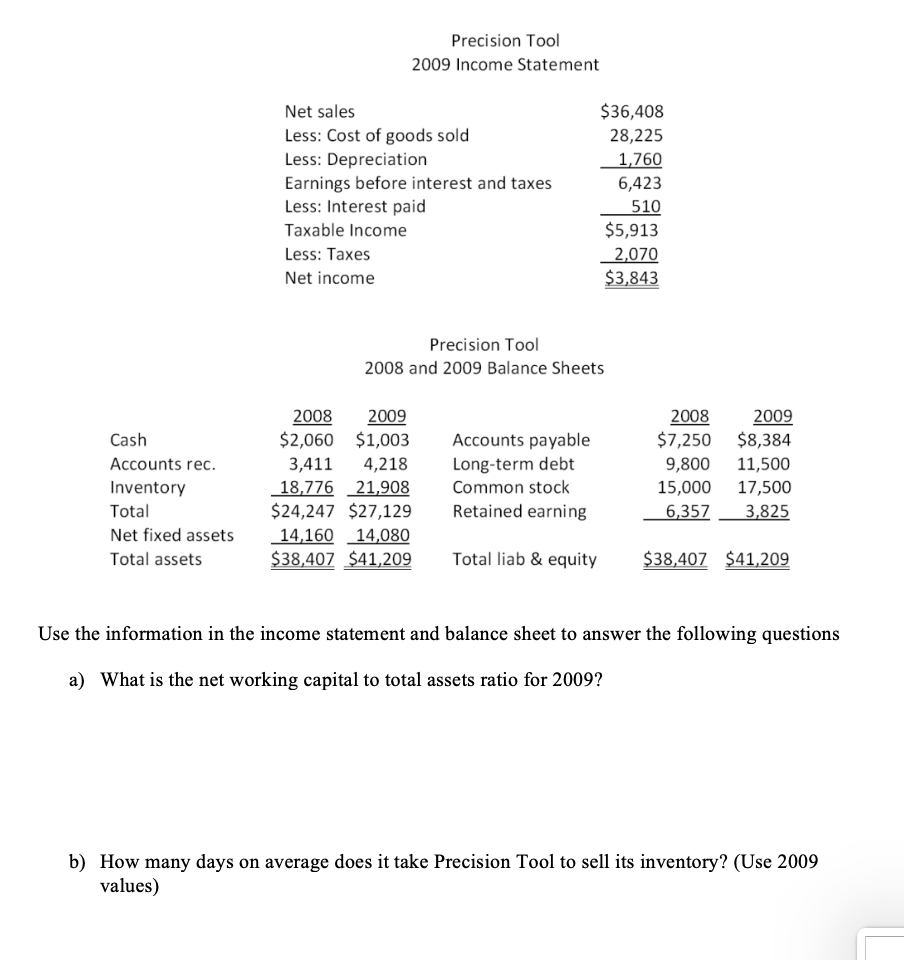

Precision Tool 2009 Income Statement $36,408 28,225 1760 6,423 Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid Taxable Income ess: Taxes Net income S5,913 2,070 $3,843 Precision Tool 2008 and 2009 Balance Sheets 2008 2009 $2,060 $1,003 Accounts payable 2009 $7,250 $8,384 9,800 11,500 15,000 17,500 2008 Cash Accounts rec. Inventory Total Net fixed assets Total assets 3,411 4,218 Long-term debt 18,776 21,908 Common stock $24,247 $27,129 14,16014,080 Retained earning 82 $38,407 S41,209 Total liab &eqity $38,407 $41,209 Use the information in the income statement and balance sheet to answer the following questions a) What is the net working capital to total assets ratio for 2009? b) How many days on average does it take Precision Tool to sell its inventory? (Use 2009 values)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts