Question: please answer both parts they go together Without leverage, Impi Corporation will have net income next year of $8.5 million. If Impi's corporate tax rate

please answer both parts they go together

please answer both parts they go together

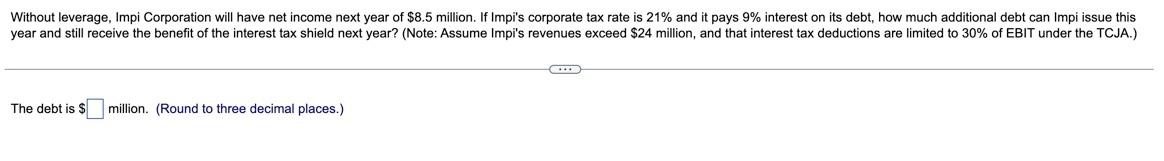

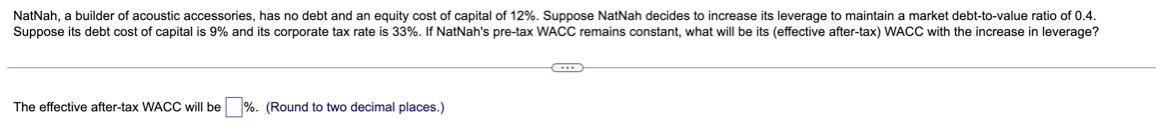

Without leverage, Impi Corporation will have net income next year of $8.5 million. If Impi's corporate tax rate is 21% and it pays 9% interest on its debt, how much additional debt can Impi issue this year and still receive the benefit of the interest tax shield next year? (Note: Assume Impi's revenues exceed \$24 million, and that interest tax deductions are limited to 30% of EBIT under the TCJA.) The debt is $ million. (Round to three decimal places.) NatNah, a builder of acoustic accessories, has no debt and an equity cost of capital of 12%. Suppose NatNah decides to increase its leverage to maintain a market debt-to-value ratio of 0.4. Suppose its debt cost of capital is 9% and its corporate tax rate is 33%. If NatNah's pre-tax WACC remains constant, what will be its (effective after-tax) WACC with the increase in leverage? The effective after-tax WACC will be \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts