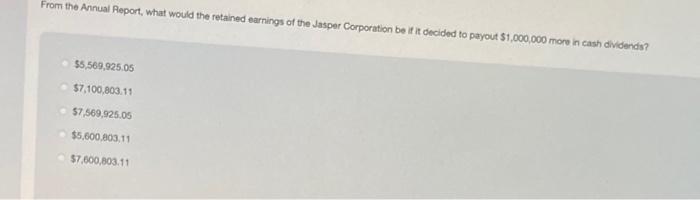

Question: please answer both parts using data From the Annual Report, what would the retained earnings of the Jasper Corporation belit decided to payout $1,000,000 more

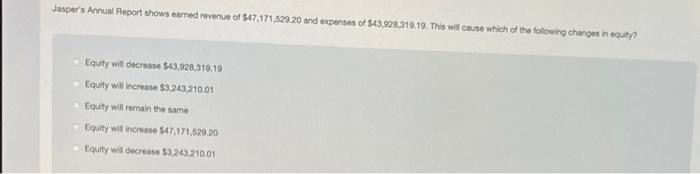

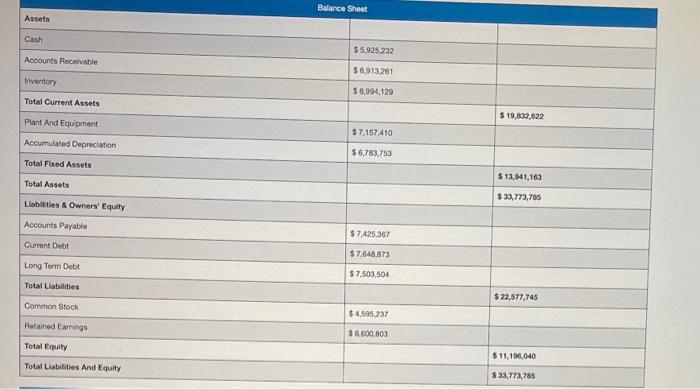

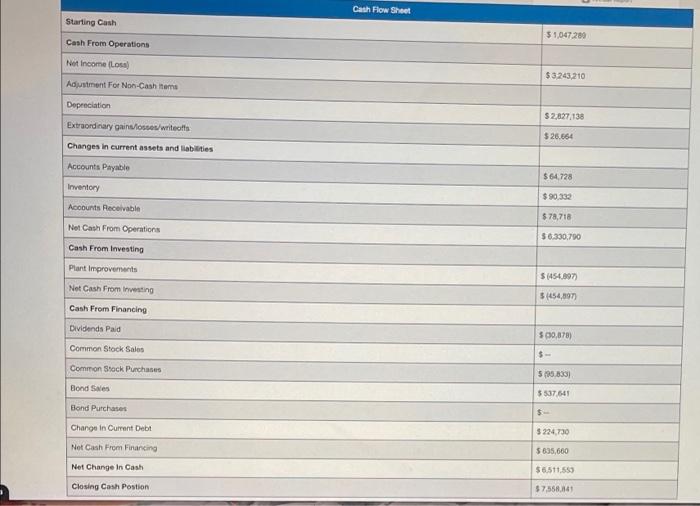

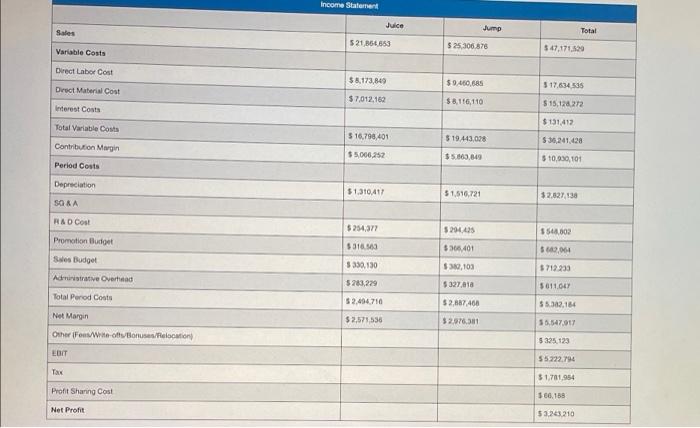

From the Annual Report, what would the retained earnings of the Jasper Corporation belit decided to payout $1,000,000 more in cash dividends? $5,569,925.05 $7,100,803.11 $7.569,925.05 $5.600.803,11 $7.600.803.11 Jasper's Annual Report shows camed revenue of 547,171,52920 and expenses of 543,928,319.19. This will cause which of the following changes in equity? Equity will decrease 543,928,319.19 Equity will increase $3.243.210.01 Equity will remain the same Equity will increase $47.171.529 20 Equity wil decrease $3.243.210,01 Balance Sheet Assets Cash $5,925,232 Accounts Receivable $6,913.261 Inventory $ 8,994,129 Total Current Assets Plant And Equipment $ 19,832,622 $ 7.157.410 Accumulated Depreciation $ 6,783,753 Total Fixed Assets $ 13,941,160 Total Assets $30,773,705 Liabilities & Owners' Equity Accounts Payable $7.425,367 Current Debt $7,648,073 Long Term Debit $7,500,504 Total Liabilities $ 22,577,745 Common Stock $4.595,237 Retained Earrings 56.600.000 Total Equity $11,190,040 Total Liabilities And Equity $33,773,785 Cash Flow Sheet Starting Cush 5 1.047.289 Cash From Operations Not Income (LO $3,243,210 Adjustment For Non-Cash items Depreciation $ 2,827,138 Extraordinary gainalosses/writeotts Changes in current assets and liabilities $26.664 Accounts Payable $64.728 Inventory $90,333 Accounts Receivable $78,718 Net Cash From Operations 56.330,790 Cash From Investing $1454097 Plant Improvements Net Cash From Investing Cash From Financing 54454,897 Dividends Paid $ 60,070) Common Stock Sales $- Common Stock Purchases 590.8331 Bond Sales 5337.641 Bond Purchases Change in Current Debt $ 224.730 Net Cash From Financing 5 635,660 $6.511.555 Not Change In Cash Closing Cash Postion $7,558.14 Income Statement Juice Jump Sales Total 52166553 525,306,878 Variable Costa $ 47.171.520 Direct Labor Cost $8,173,840 $9.460.686 Direct Material Cost $17.634 535 $7,012,162 $8,116,110 $15.120272 Interest Costs $ 131,412 Total Variable Costs 516,798,401 Contribution Margin $ 19.443,028 $5.060,849 $35,241,428 $10,030,101 $5.000,252 Period Costs Depreciation $1,310,417 51.516,721 $2.027130 SO &A RAD Cost 5254,377 529442 354 302 Promotion Budget $310.00 $365,401 $12.064 Sales Budget $350,130 $32,103 $712230 Administrative Overhead $283,229 $327 610 5611.047 Total Porod Costs 52.404.710 $ 2,887,460 $5.382.184 Net Margin $ 2,575,536 $ 276.381 55.547,017 Other FeWitt-ott Bonus/Relocation $325,123 EDIT 55222.794 Tax 51.781,954 Profit Sharing Cost 160.188 Net Profit 53.233.210

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts