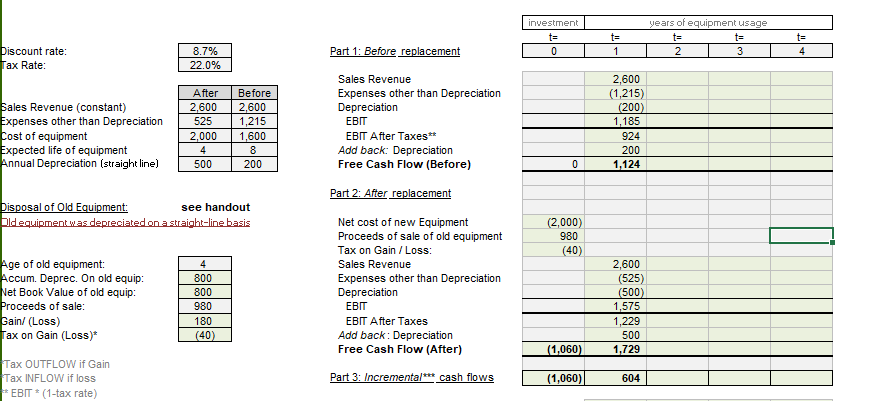

Question: Please Answer Both Parts with Excel Functions/Formulas! investment t= 0 years of equipment usage t= 2 3 1 Discount rate: Tax Rate: Part 1: Before

Please Answer Both Parts with Excel Functions/Formulas!

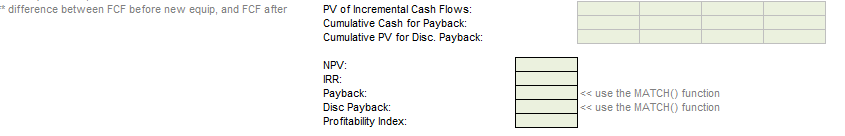

investment t= 0 years of equipment usage t= 2 3 1 Discount rate: Tax Rate: Part 1: Before replacement 4 8.7% 22.0% Sales Revenue constant) Expenses other than Depreciation Cost of equipment Expected life of equipment Annual Depreciation (straight line) After 2,600 525 2,000 4 500 Before 2,600 1,215 1,600 8 200 Sales Revenue Expenses other than Depreciation Depreciation EBIT EBIT After Taxes** Add back: Depreciation Free Cash Flow (Before) 2,600 (1,215) (200) 1,185 924 200 1,124 0 Disposal of Old Equipment: see handout bildequipment was depreciated on a straight-line basis (2,000 980 (40) Age of old equipment: Accum. Deprec. On old equip: Net Book Value of old equip: Proceeds of sale: Gain/ (Loss) Tax on Gain (Loss)* 4 800 800 980 180 (40) Part 2: After replacement Net cost of new Equipment Proceeds of sale of old equipment Tax on Gain / Loss: Sales Revenue Expenses other than Depreciation Depreciation EBIT EBIT After Taxes Add back: Depreciation Free Cash Flow (After) 2,600 (525) (500) 1,575 1,229 500 1,729 (1,060) Tax OUTFLOW if Gain Tax INFLOW if loss EBIT *(1-tax rate) Part 3: Incremental*** cash flows (1,060) 604 * difference between FCF before new equip, and FCF after PV of Incremental Cash Flows: Cumulative Cash for Payback: Cumulative PV for Disc. Payback: NPV: IRR: Payback: Disc Payback: Profitability Index:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts