Question: Please answer both Problems 1 & 2 and Calculate numbers #1 - 4 on the bottom. Please show all the work if any work is

Please answer both Problems 1 & 2 and Calculate numbers #1 - 4 on the bottom. Please show all the work if any work is needed to get the answers.

Answer the two problems along with the Common stock questions (#1-4) on the bottoms Thank you!

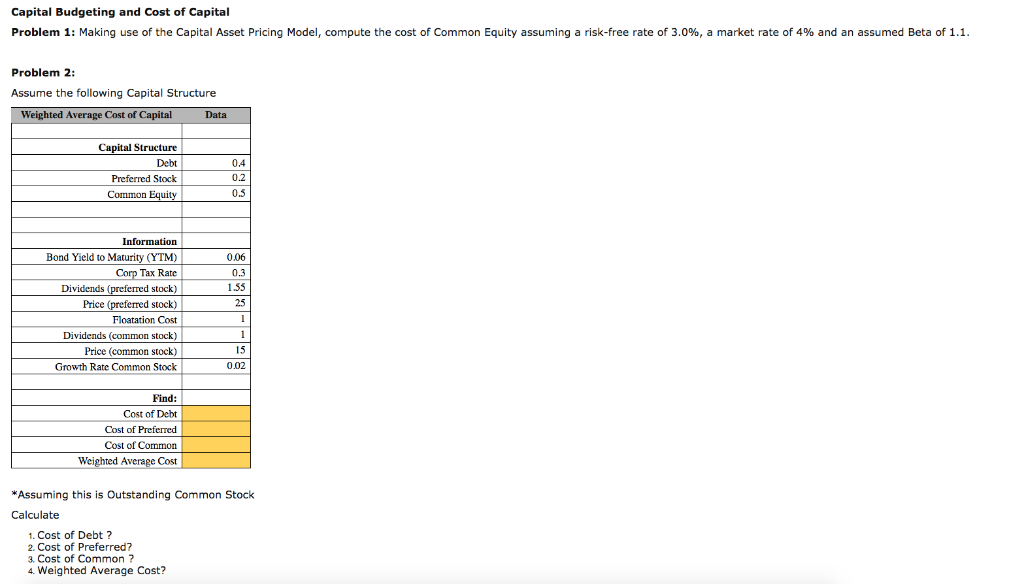

Capital Budgeting and Cost of Capital Problem 1: Making use of the Capital Asset Pricing Model, compute the cost of Common Equity assuming a risk-free rate of 3.0%, a market rate of 4% and an assumed Beta of 1.1 Problem 2: Assume the following Capital Structure Weighted Average Cost of Capital Data Capital Structure Debt Preferred Stock 04 0.2 0.5 Common Information Bond Yield to Maturity (YTM) Tax Rate stock) Price (preferred stock) Floatation Cost Dividends (common stock) Price (common stock) Growth Rate Common Stock 0.06 0.3 1.55 25 Dividends( 15 002 Find: Cost of Debt Cost of Preferred Cost of Common e Cost Wei Aw *Assuming this is Outstanding Common Stock Calculate 1. Cost of Debt ? 2. Cost of Preferred? 3. Cost of Common? 4. Weighted Average Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts