Question: Please answer both Q1 and 2 Determine whether the following assets are ordinary, capital, pure 1231,1231/1245, or 1231/1250 assets: - An Apple computer that a

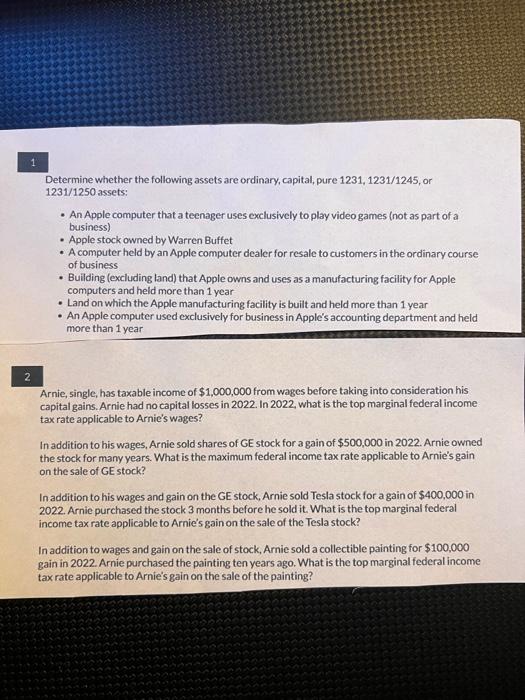

Determine whether the following assets are ordinary, capital, pure 1231,1231/1245, or 1231/1250 assets: - An Apple computer that a teenager uses exclusively to play video games (not as part of a business) - Apple stock owned by Warren Buffet - A computer held by an Apple computer dealer for resale to customers in the ordinary course of business - Building (excluding land) that Apple owns and uses as a manufacturing facility for Apple computers and held more than 1 year - Land on which the Apple manufacturing facility is built and held more than 1 year - An Apple computer used exclusively for business in Apple's accounting department and held more than 1 year 2 Arnie, single, has taxable income of $1,000,000 from wages before taking into consideration his capital gains. Arnie had no capital losses in 2022. In 2022, what is the top marginal federal income tax rate applicable to Arnie's wages? In addition to his wages, Arnie sold shares of GE stock for a gain of $500,000 in 2022 . Arnie owned the stock for many years. What is the maximum federal income tax rate applicable to Arnie's gain on the sale of GE stock? In addition to his wages and gain on the GE stock, Arnie sold Tesla stock for a gain of $400,000 in 2022. Arnie purchased the stock 3 months before he sold it. What is the top marginal federal income tax rate applicable to Arnie's gain on the sale of the Tesla stock? In addition to wages and gain on the sale of stock, Arnie sold a collectible painting for $100,000 gain in 2022. Amie purchased the painting ten years ago. What is the top marginal federal income tax rate applicable to Arnie's gain on the sale of the painting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts