Question: please answer both que 29 and 34. thank you Question 29 (1 point) 4) Listen Your research department has provided you with a Return Expectation

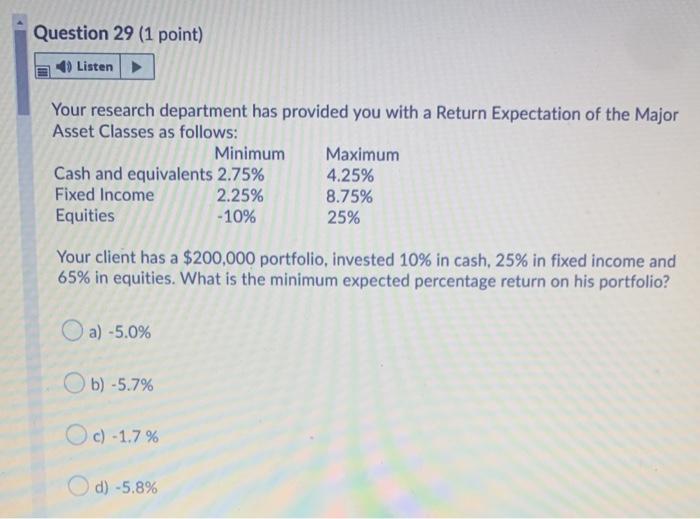

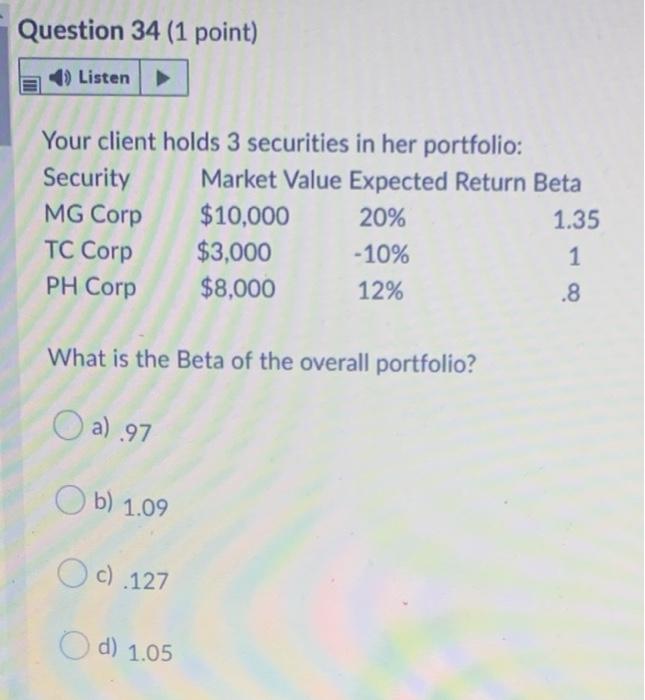

Question 29 (1 point) 4) Listen Your research department has provided you with a Return Expectation of the Major Asset Classes as follows: Minimum Maximum Cash and equivalents 2.75% 4.25% Fixed Income 2.25% 8.75% Equities -10% 25% Your client has a $200,000 portfolio, invested 10% in cash, 25% in fixed income and 65% in equities. What is the minimum expected percentage return on his portfolio? a) -5.0% b) -5.7% c) -1.7% d) -5.8% Question 34 (1 point) Listen Your client holds 3 securities in her portfolio: Security Market Value Expected Return Beta MG Corp $10,000 20% 1.35 TC Corp $3,000 - 10% 1 PH Corp $8,000 12% .8 What is the Beta of the overall portfolio? a) 97 b) 1.09 c) 127 d) 1.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts