Question: Please answer both quedtions. Thank you! Homework: Chapter 14 Homework Spring 2022 Question 2, Problem 14-4 (algorithmic) HW Score: 0%, 0 of 15 points O

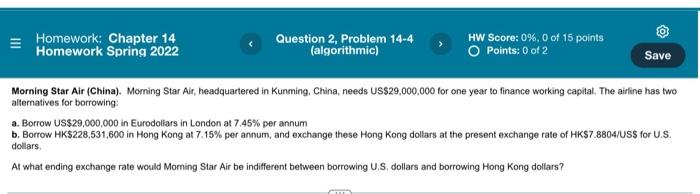

Homework: Chapter 14 Homework Spring 2022 Question 2, Problem 14-4 (algorithmic) HW Score: 0%, 0 of 15 points O Points: 0 of 2 Save Morning Star Air (China). Morning Star Air, headquartered in Kunming, China, needs US$29,000,000 for one year to finance working capital. The airline has two alternatives for borrowing: a. Borrow US$29,000,000 in Eurodollars in London at 7.45% per annum b. Borrow HKS228,531,600 in Hong Kong at 7.15% per annum, and exchange these Hong Kong dollars at the present exchange rate of HK$7.8804/US5 for U.S. dollars At what ending exchange rate would Morning Star Air be indifferent between borrowing U.S. dollars and borrowing Hong Kong dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts