Question: please answer both QUESTION 10 HEB is considering opening a new store in Houston Building the store will cost 53 M today. They expect to

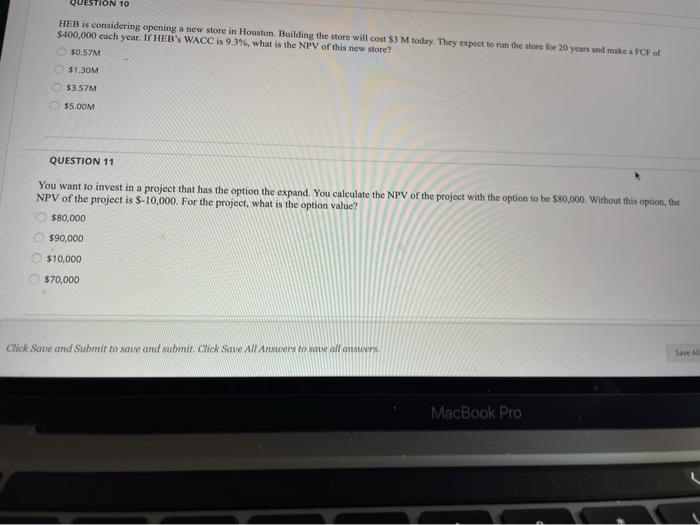

QUESTION 10 HEB is considering opening a new store in Houston Building the store will cost 53 M today. They expect to run the store for 20 years and makes FCF of $400,000 cach year. If HEB'S WACC is 9.3%, what is the NPV of this new store! 50:57M $1.30M $3.57M $5.00M QUESTION 11 You want to invest in a project that has the option the expand. You calculate the NPV of the project with the option to be 580,000. Without this option, the NPV of the project is $-10,000. For the project, what is the option value? $80,000 $90,000 $10,000 $70,000 Click Save and Submit to save and submit. Click Savell Ansure to save all answers Save All MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts