Question: Please answer both Question 16 (1 point) When analyzing a set of capital budgeting alternatives, a firm should always choose the ones which add the

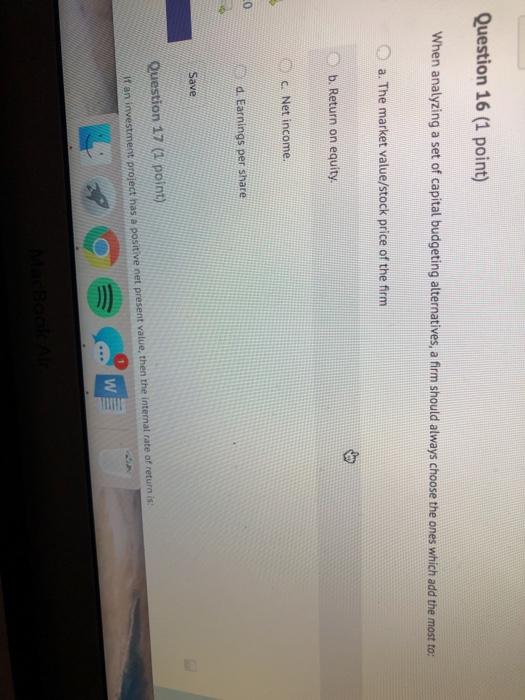

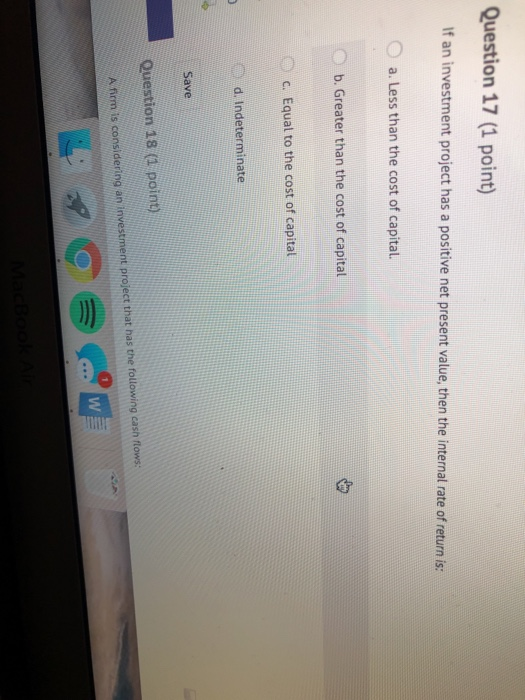

Question 16 (1 point) When analyzing a set of capital budgeting alternatives, a firm should always choose the ones which add the most to: O a. The market value/stock price of the firm b. Return on equity c. Net income. (r) d. Earnings per share Save Question 17 (2 point) If an investment project has a positive net present value, then the internal rate of return is: Question 17 (1 point) If an investment project has a positive net present value, then the internal rate of return is: 0 a. Less than the cost of capital. b. Greater than the cost of capital c. Equal to the cost of capital d. Indeterminate Save Question 18 (1 point) A firm is considering an investment project that has the following cash flowss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts