Question: please answer both! Question 3 (2 points) Marie's Fashions is considering a project that will require $30,000 in net working capital and $93,000 in fixed

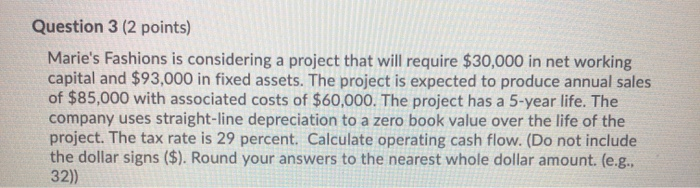

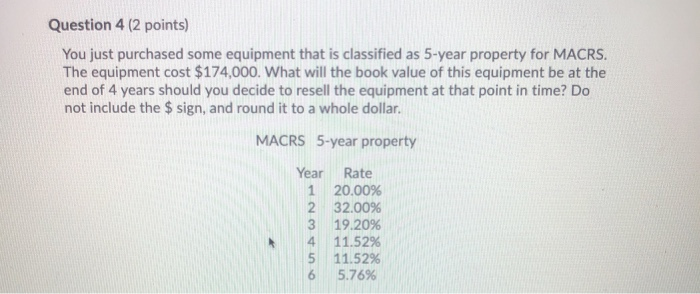

Question 3 (2 points) Marie's Fashions is considering a project that will require $30,000 in net working capital and $93,000 in fixed assets. The project is expected to produce annual sales of $85,000 with associated costs of $60,000. The project has a 5-year life. The company uses straight-line depreciation to a zero book value over the life of the project. The tax rate is 29 percent. Calculate operating cash flow. (Do not include the dollar signs ($). Round your answers to the nearest whole dollar amount. (e.g., 32)) Question 4 (2 points) You just purchased some equipment that is classified as 5-year property for MACRS. The equipment cost $174,000. What will the book value of this equipment be at the end of 4 years should you decide to resell the equipment at that point in time? Do not include the $ sign, and round it to a whole dollar MACRS 5-year property Year 2 3 4 Rate 20.00% 32.00% 19.20% 11.52% 11.52% 5.76%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts