Question: please answer both question also do show work thanks question 1 question 2 Complete the top portion and earnings section of a payroll register for

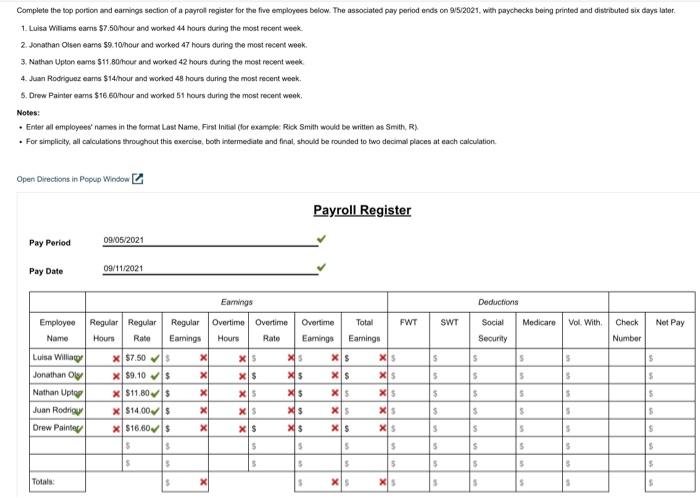

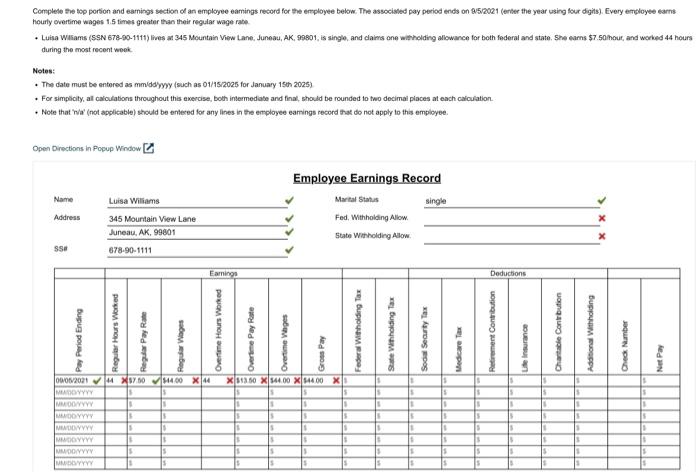

Complete the top portion and earnings section of a payroll register for the five employees below. The associated pay period ends on 9/5/2021, with paychecks being printed and distributed six days later. 1. Luisa Wiliams earns $7.50/hour and worked 44 hours during the most recent week. 2. Jonathan Olseneams $9.10/hour and worked 47 hours during the most recent week. 3. Nathan Upton eams $11.80/hour and worked 42 hours during the most recent week 4. Juan Rodriguez eams $14/hour and worked 48 hours during the most recent week. 5. Drew Painter earns $16.50/hour and worked 51 hours during the most recent week. Notes: Enter all employees' names in the format Last Name, First Initial (for example: Rick Smith would be written as Smith, R) . For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation Open Directions in Popup Window Payroll Register 09/05/2021 Pay Period Pay Date 09/11/2021 Earnings Deductions Total FWT Net Pay Overtime Earings Earnings Social Security Rate Regular Regular Regular Overtime Overtime Hours Rate Earnings Hours x $7.50$ x 59.10 $ x XS Employee Name Luisa Williag Jonathan Oly Nathan Uptog Juan Rodrigu Drew Painte XS x xs XS x $11.80 $ x XS XS x $14.00 $ XS XS x $16.60 $ XS xs $ $ S Totals: $ S $ x x S xs xs xs xs xs S $ $ S $ xs xs xs xs xs xs $ 5 xs SWT S 5 $ $ S S $ $ $ $ $ $ S S $ $ Medicare Vol. With S S S $ $ S S $ $ S S $ S S $ S Check Number S S $ $ $ S $ $ Complete the top portion and earnings section of an employee eamings record for the employee below. The associated pay period ends on 9/5/2021 (enter the year using four digits). Every employee earns hourly overtime wages 1.5 times greater than their regular wage rate Luisa Williams (SSN 678-90-1111) lives at 345 Mountain View Lane, Juneau, AK, 99801, is single, and claims one withholding allowance for both federal and state. She earns $7.50/hour, and worked 44 hours during the most recent week Notes: The date must be entered as mm/dd/yyyy (such as 01/15/2025 for January 15th 2025) . For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. . Note that wa' (not applicable) should be entered for any lines in the employee eamings record that do not apply to this employee. Open Directions in Popup Window Employee Earnings Record Name Luisa Williams Marital Status single Address Fed. Withholding Allow 345 Mountain View Lane Juneau, AK, 99801 State Withholding Allow SS# 678-90-1111 Pay Period Ending Regular Hours Worked Regular Pay Rate 11 syys 11 $ Earnings Overtime Hours Worked Overtime Pay Rate 09/05/202144 X$7.50$44.00 X 44 X$13.50 X544.00 X 144.00 XI MADDYYYY MM/DD/YYYY | S $ 11 Is MADDYYYY |8 |$ |$ |S MADD/YYYY S 1 11 11 MMDDYYYY MM/DD/YYYY MM/DD/YYYY $ 8 Overtime Wages Federal Withholding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution Gross Pay Life Insurance Chantable Contribution Additional Withholding Check Number Net Pay 15 IS Is 11 S 1 15 11 11 $ 11 1 1 S $ S 13 Deductions S B $ $ B 1 11 S 1 S s S B S 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts