Question: please answer both question and thank you se Maps Saved The balance sheet for Quinn Corporation is shown here in market value terms. There are

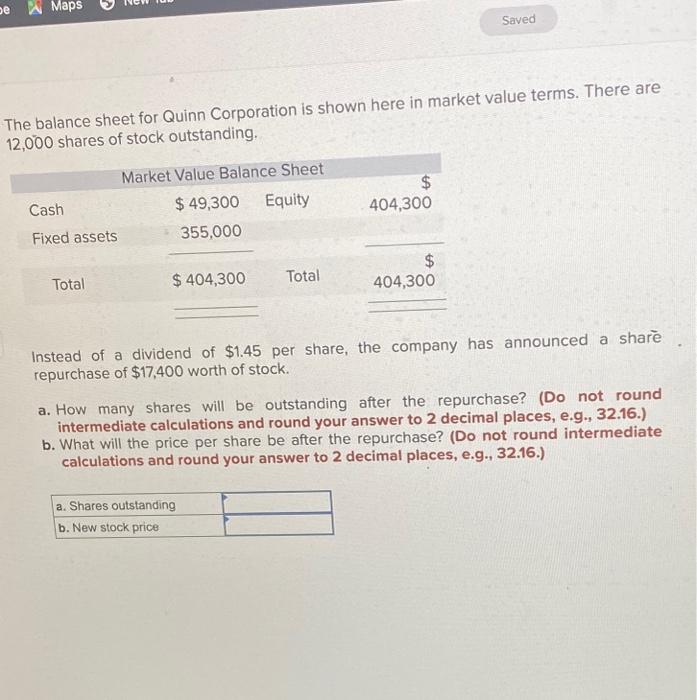

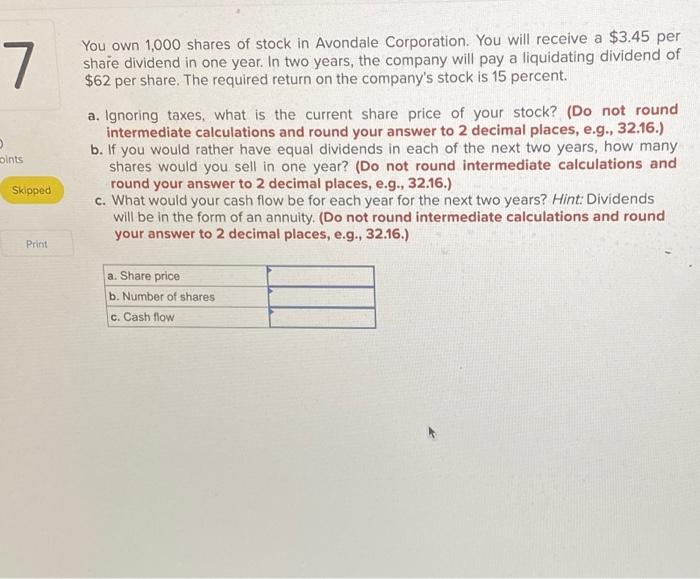

se Maps Saved The balance sheet for Quinn Corporation is shown here in market value terms. There are 12,000 shares of stock outstanding. ta Market Value Balance Sheet Cash $ 49,300 Equity Fixed assets 355,000 $ 404,300 $ 404,300 Total $ 404,300 Total Instead of a dividend of $1.45 per share, the company has announced a share repurchase of $17,400 worth of stock. a. How many shares will be outstanding after the repurchase? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What will the price per share be after the repurchase? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Shares outstanding b. New stock price 7 You own 1,000 shares of stock in Avondale Corporation. You will receive a $3.45 per share dividend in one year. In two years, the company will pay a liquidating dividend of $62 per share. The required return on the company's stock is 15 percent. a. Ignoring taxes, what is the current share price of your stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If you would rather have equal dividends in each of the next two years, how many shares would you sell in one year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What would your cash flow be for each year for the next two years? Hint: Dividends will be in the form of an annuity. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Dints Skipped Print a. Share price b. Number of shares c. Cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts