Question: please answer both questions 1 and 2 1. Alpha obtains 100% of Beta on January 1, Year 1. Alpha spent $10,000,000 in cash, and also

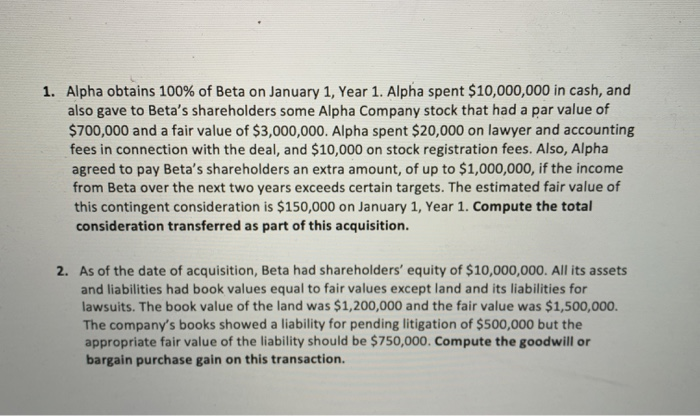

1. Alpha obtains 100% of Beta on January 1, Year 1. Alpha spent $10,000,000 in cash, and also gave to Beta's shareholders some Alpha Company stock that had a par value of $700,000 and a fair value of $3,000,000. Alpha spent $20,000 on lawyer and accounting fees in connection with the deal, and $10,000 on stock registration fees. Also, Alpha agreed to pay Beta's shareholders an extra amount, of up to $1,000,000, if the income from Beta over the next two years exceeds certain targets. The estimated fair value of this contingent consideration is $150,000 on January 1, Year 1. Compute the total consideration transferred as part of this acquisition. 2. As of the date of acquisition, Beta had shareholders' equity of $10,000,000. All its assets and liabilities had book values equal to fair values except land and its liabilities for lawsuits. The book value of the land was $1,200,000 and the fair value was $1,500,000. The company's books showed a liability for pending litigation of $500,000 but the appropriate fair value of the liability should be $750,000. Compute the goodwill or bargain purchase gain on this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts