Question: Please answer both questions! 22. Under ERISA, pension fund managers are required to invest fund assets as wisely as if they were investing their own

Please answer both questions!

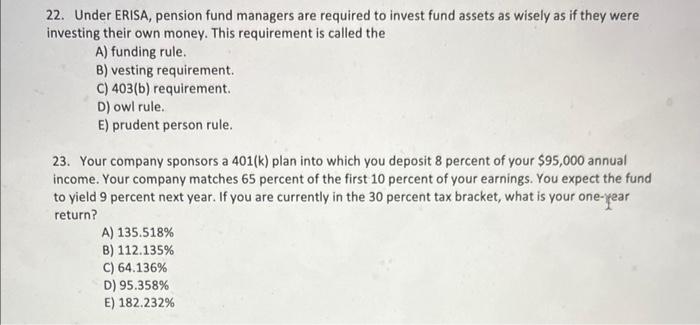

22. Under ERISA, pension fund managers are required to invest fund assets as wisely as if they were investing their own money. This requirement is called the A) funding rule. B) vesting requirement. C) 403(b) requirement. D) owl rule. E) prudent person rule. 23. Your company sponsors a 401(k) plan into which you deposit 8 percent of your $95,000 annual income. Your company matches 65 percent of the first 10 percent of your earnings. You expect the fund to yield 9 percent next year. If you are currently in the 30 percent tax bracket, what is your one-year return? A) 135.518% B) 112.135% C) 64.136% D) 95.358% E) 182.232%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock