Question: Please answer both questions! 25. Suppose that a corporate defined benefit plan had decided it will keep pension fund reserves equal to the present value

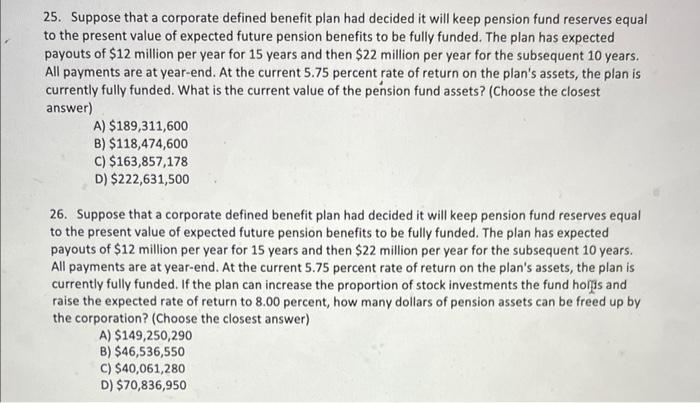

25. Suppose that a corporate defined benefit plan had decided it will keep pension fund reserves equal to the present value of expected future pension benefits to be fully funded. The plan has expected payouts of $12 million per year for 15 years and then $22 million per year for the subsequent 10 years. All payments are at year-end. At the current 5.75 percent rate of return on the plan's assets, the plan is currently fully funded. What is the current value of the pension fund assets? (Choose the closest answer) A) $189,311,600 B) $118,474,600 C) $163,857,178 D) $222,631,500 26. Suppose that a corporate defined benefit plan had decided it will keep pension fund reserves equal to the present value of expected future pension benefits to be fully funded. The plan has expected payouts of $12 million per year for 15 years and then $22 million per year for the subsequent 10 years. All payments are at year-end. At the current 5.75 percent rate of return on the plan's assets, the plan is currently fully funded. If the plan can increase the proportion of stock investments the fund hoifs and raise the expected rate of return to 8.00 percent, how many dollars of pension assets can be freed up by the corporation? (Choose the closest answer) A) $149,250,290 B) $46,536,550 C) $40,061,280 D) $70,836,950

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts