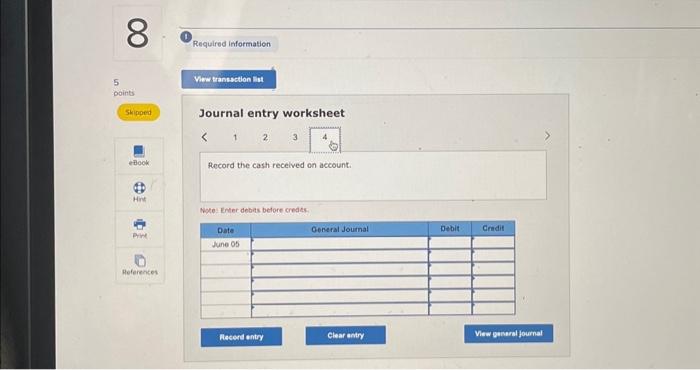

Question: please answer both questions #8 and #10 Journal entry worksheet 4 Record the estimated bad debts expense. Note: Enter debits before credits Use the calculated

![the questions displayed below] Following are transactions of Danica Company. socount receivable.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e304041f272_73166e30403bfdc3.jpg)

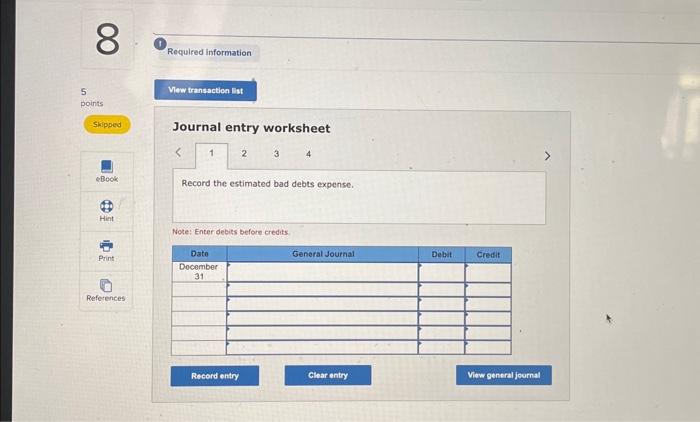

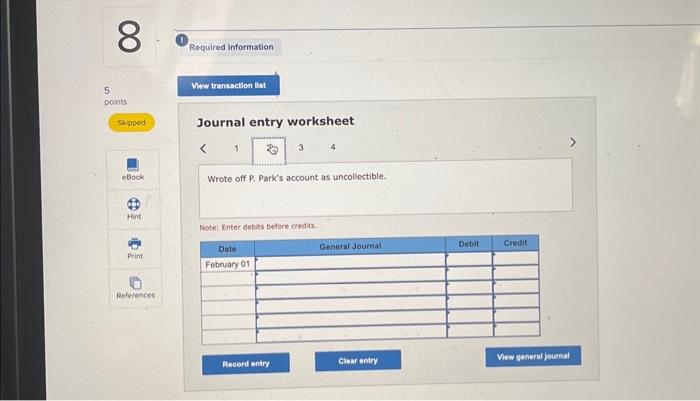

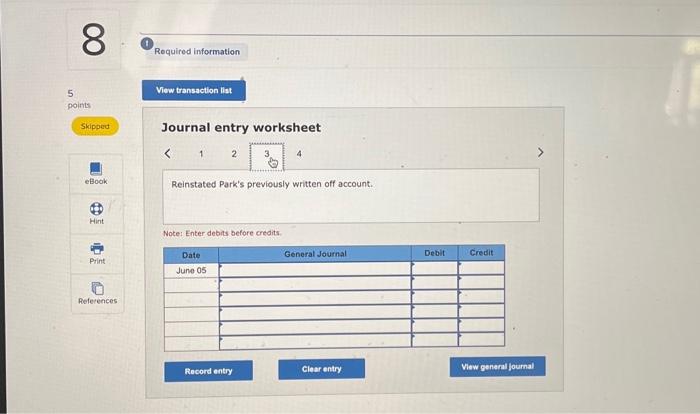

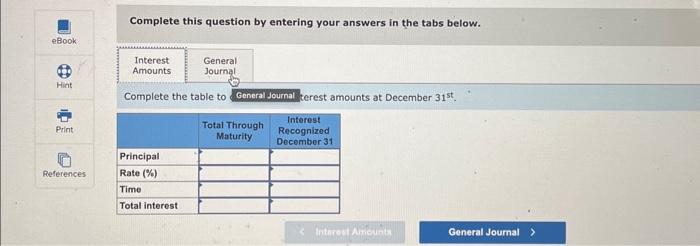

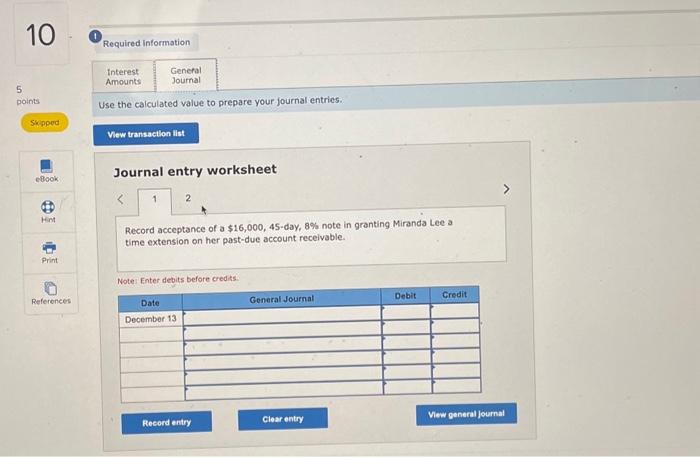

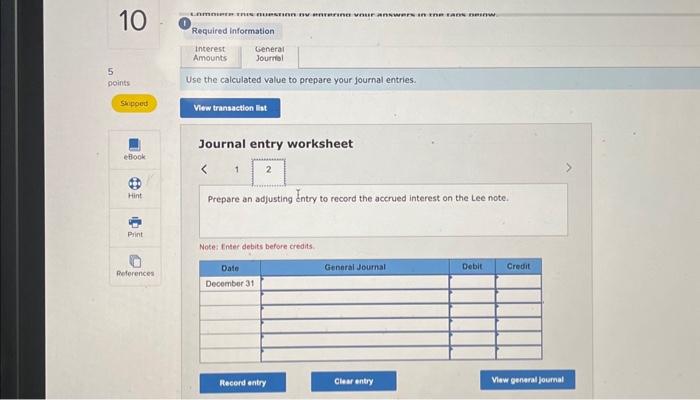

Journal entry worksheet 4 Record the estimated bad debts expense. Note: Enter debits before credits Use the calculated value to prepare your journal entries. Journal entry worksheet Prepare an adjusting Intry to record the accrued interest on the Lee note. Note: Enter debits before credits Required information [The following information applies to the questions displayed below] Following are transactions of Danica Company. socount receivable. Complete the table to calculate the interest amounts at December 31st and use the calculated volue to prepare your joumal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Journal entry worksheet 4 Wrote off P. Park's account as uncollectible. Notet Enter debits before oredits. Journal entry worksheet fecord the casth recelved on account. Note: Enter debats belore credes. Use the calculated value to prepare your journal entries. Journal entry worksheet Record acceptance of a $16,000,45-day, 8% note in granting Miranda Lee a time extension on her past-due account receivable. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below] At year-end December 31, Chan Company estimates its bad debts as 0.30% of its annual credit sales of $914,000. Chan records its bad debts expense for thot estimate. On the following February 1 , Chan decides that the $457 account of P. Park is uncollectible and writes it off as a bad debt. On June 5 . Park unexpectedly pays the amount previously written off. Prepare Chan's journal entries to fecord the transactions of December 31 , February 1, and June 5 . Journal entry worksheet 4 Reinstated Park's previously written off account. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Complete the table to General Journal terest amounts at December 31st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts