Question: Please answer BOTH questions !!! A European borrower borrows $565,000 from an American bank for one year. The interest rate is 4%. The exchange rate

Please answer BOTH questions !!!

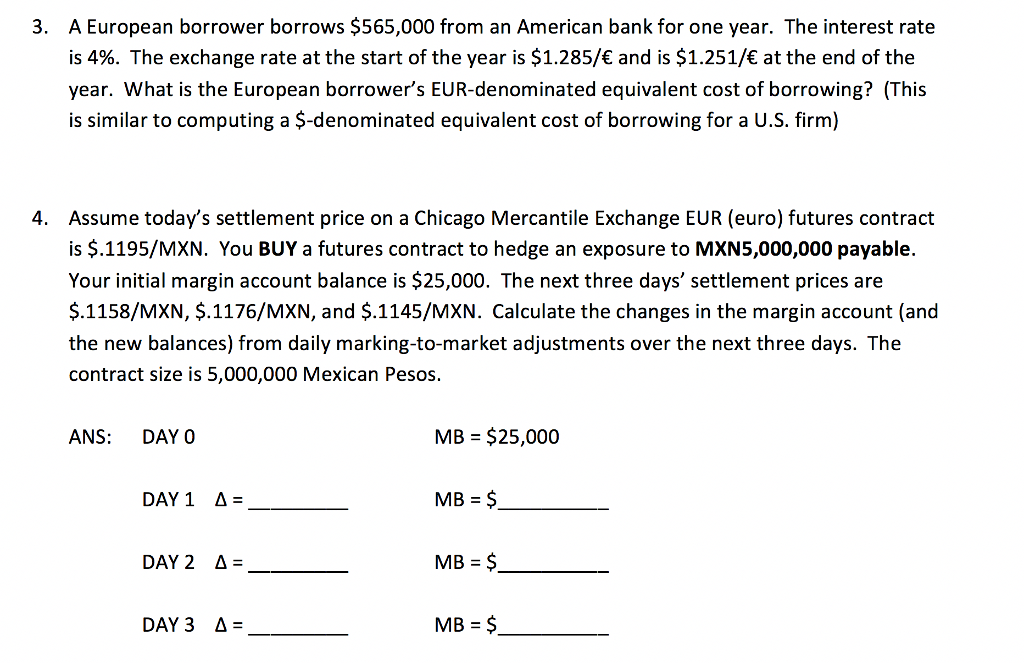

A European borrower borrows $565,000 from an American bank for one year. The interest rate is 4%. The exchange rate at the start of the year is $1.285/ and is $1.251/C at the end of the year. What is the European borrower's EUR-denominated equivalent cost of borrowing? (This is similar to computing a $-denominated equivalent cost of borrowing for a U.S. firm) 3. Assume today's settlement price on a Chicago Mercantile Exchange EUR (euro) futures contract is $.1195/MXN. You BUY a futures contract to hedge an exposure to MXN5,000,000 payable. Your initial margin account balance is $25,000. The next three days' settlement prices are $.1158/MXN, $.1176/MXN, and $.1145/MXN. Calculate the changes in the margin account (and the new balances) from daily marking-to-market adjustments over the next three days. The contract size is 5,000,000 Mexican Pesos. 4. ANS DAY MB = $25,000 MB $ MB=$. MB $ DAY 1 = DAY2 = DAY3 =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts