Question: PLEASE ANSWER BOTH QUESTIONS, ALSO PLEASE PROVIDE FORMULAS USED. PLEASE DO CALCULATION CAREFULLY MOST OF THE TIME THE ANSWER YOU GUYS PROVIDE ARE INCORRECT. PLEASE

PLEASE ANSWER BOTH QUESTIONS, ALSO PLEASE PROVIDE FORMULAS USED. PLEASE DO CALCULATION CAREFULLY MOST OF THE TIME THE ANSWER YOU GUYS PROVIDE ARE INCORRECT. PLEASE HELP.

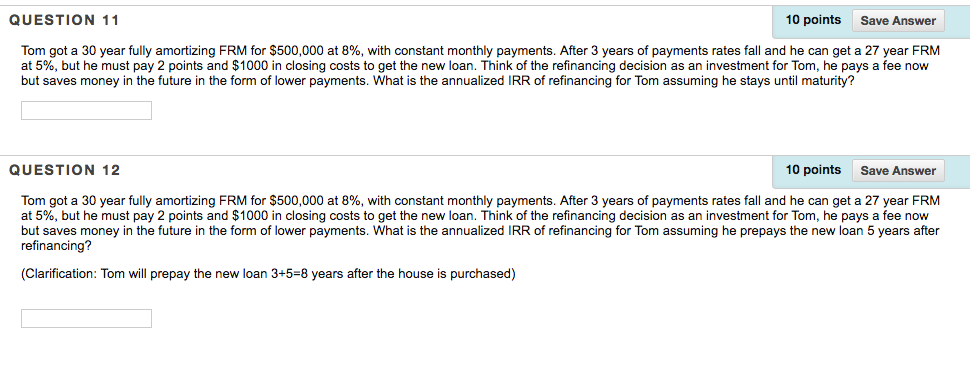

QUESTION 11 10 points Save Answer Tom got a 30 year fully amortizing FRM for $500,000 at 8%, with constant monthly payments. After 3 years of payments rates fall and he can get a 27 year FRM at 5%, but he must pay 2 points and $1000 in closing costs to get the new loan. Think of the refinancing decision as an investment for Tom, he pays a fee now but saves money in the future in the form of lower payments. What is the annualized IRR of refinancing for Tom assuming he stays until maturity? QUESTION 12 10 points Save Answer Tom got a 30 year fully amortizing FRM for $500,000 at 8%, with constant monthly payments. After 3 years of payments rates fall and he can get a 27 year FRM at 5%, but he must pay 2 points and $1000 in closing costs to get the new loan. Think of the refinancing decision as an investment for Tom, he pays a fee now but saves money in the future in the form of lower payments. What is the annualized IRR of refinancing for Tom assuming he prepays the new loan 5 years after refinancing? (Clarification: Tom will prepay the new loan 3+5-8 years after the house is purchased)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts