Question: Please answer both questions as no more remaining! Thumbs up! During the past 10 years, the percent returns on two mutual funds (aggressive and passive)

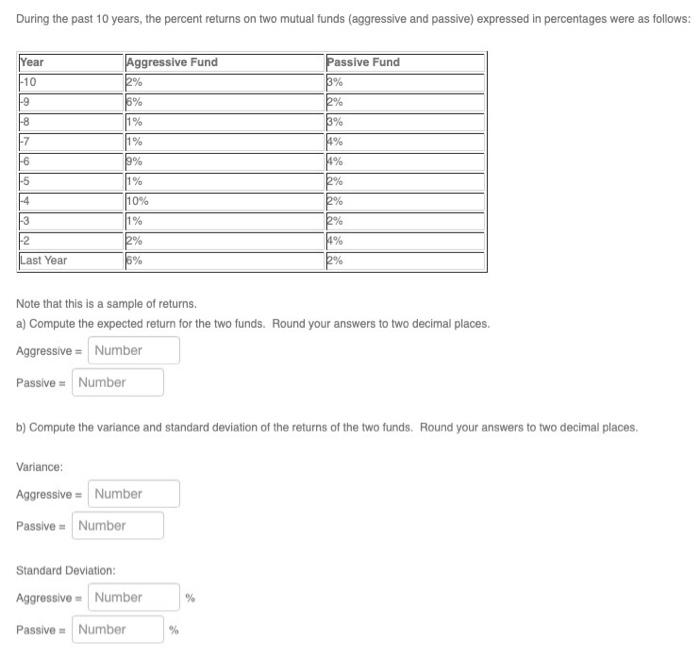

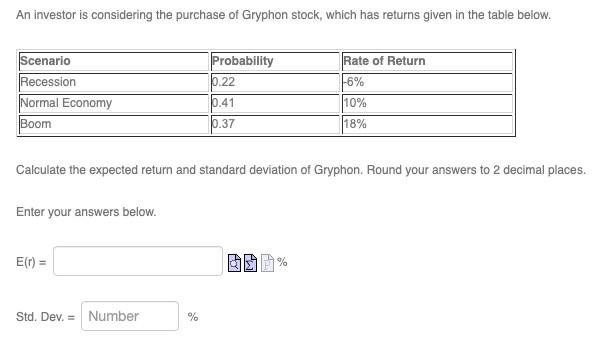

During the past 10 years, the percent returns on two mutual funds (aggressive and passive) expressed in percentages were as follows Year -10 Aggressive Fund 2% 5% 19 Passive Fund 3% 2% 3% 4% 14% 8 1% -7 1% 9% 16 -5 11% 4 3 10% 11% 2% % 2% 4% 2 Last Year 2% Note that this is a sample of returns. a) Compute the expected return for the two funds. Round your answers to two decimal places. Aggressive = Number Passive = Number b) Compute the variance and standard deviation of the returns of the two funds. Round your answers to two decimal places Variance: Aggressive - Number Passive Number Standard Deviation: Aggressive Number % Passive Number % An investor is considering the purchase of Gryphon stock, which has returns given in the table below. Scenario Recession Normal Economy Boom Probability 0.22 0.41 0.37 Rate of Return -6% 10% 18% Calculate the expected return and standard deviation of Gryphon. Round your answers to 2 decimal places. Enter your answers below. E(t) = Std. Dev. = Number %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts