Question: please answer both questions clearly 5) You are long a $85 put on 100 shares of Merck with a premium of $3.38/share. When the option

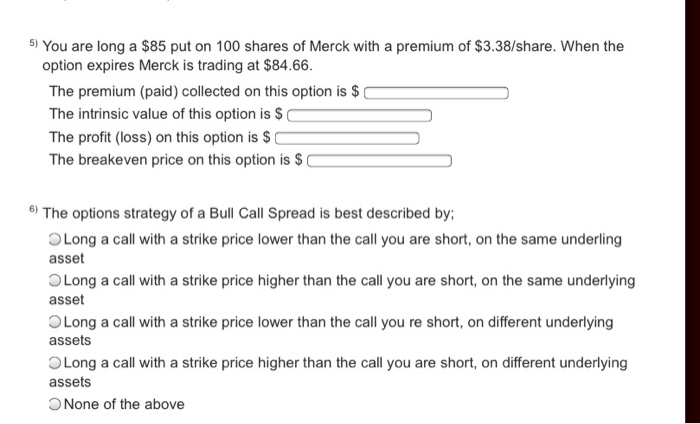

5) You are long a $85 put on 100 shares of Merck with a premium of $3.38/share. When the option expires Merck is trading at $84.66. The premium (paid) collected on this option is $ The intrinsic value of this option is $ The profit (loss) on this option is $ The breakeven price on this option is $ 6) The options strategy of a Bull Call Spread is best described by: Long a call with a strike price lower than the call you are short, on the same underling asset Long a call with a strike price higher than the call you are short, on the same underlying asset Long a call with a strike price lower than the call you re short, on different underlying assets Long a call with a strike price higher than the call you are short, on different underlying assets None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts