Question: please answer both questions for a thumbs up. ellook A mutuni tund manager hon a $20 million portfolio with a beta of 1.30. The risk

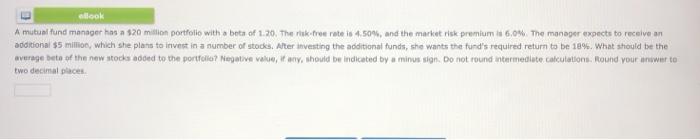

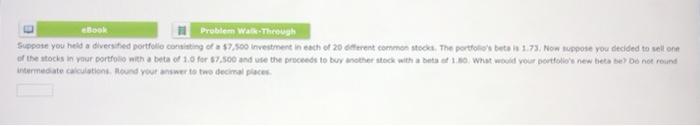

ellook A mutuni tund manager hon a $20 million portfolio with a beta of 1.30. The risk free rate is 4,50%, and the market risk premium de 6,0%. The manager expects to receive an additional $5 million, which she plans to invest in a number of stocks. Alter investing the additional tunds, she wants the fund's required return to be 18%. What should be the average beta of the new stocks adoed to the portfolio? Negative value, tany, should be indicated by a minus sign. Do not round untermediate calculations. Round your inwer to two decimal places eBook Problem Walk Theough Suppose you held a diversified portfolio carining of $7.500 Investment neath of 20 offerent common stoc. The portfool but i 1.73, Now suppose you decided to selt on of the stocks in your portfolio with a bea of 1.0 for $7.500 and use the proceeds to buy mother stock with but what would your portfolio new teta u Do not round termediate action Hound your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts