Question: please answer both questions. Problem 6.1 () Apension fund manager is considering three mutual funds. The first is a stock tund, the second is a

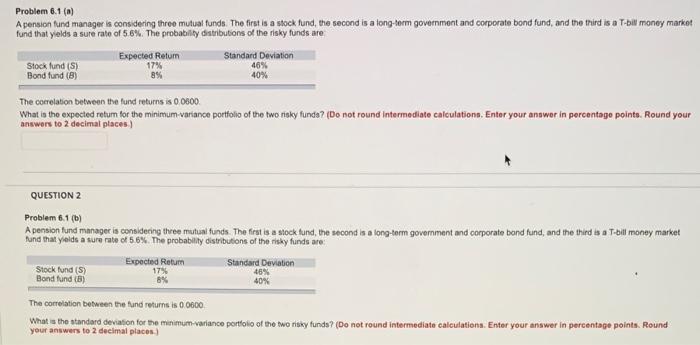

Problem 6.1 () Apension fund manager is considering three mutual funds. The first is a stock tund, the second is a long-term government and corporato bond fund, and the third is a T-bilt money market fund that yields a sure rate of 5.6%. The probability distributions of the risky funds are Stock fund (S) Bond fund (8) Expected Return 17% 85 Standard Deviation 46% 40% The correlation between the fund returns is 0.0000 What is the expected retum for the minimum.variance portfolio of the two nisky funda? (Do not round Intermediate calculations. Enter your answer in percentage points. Round your answers to 2 decimal places) QUESTION 2 Problem 6.1 (b) A pension fund manager is considering three mutual funds. The first is a stock tund, the second is a long-term government and corporate band fund, and the third is a T-bil money market yields of %The of the are Stock fund (S) Bond fund (5) Expected Retum 175 8% Standard Deviation 46% 40% The correlation between the fund returns is 00600 What is the standard deviation for the minimum variance portfolio of the two risky funds ? (Do not round intermediate calculations. Enter your answer in percentage points. Round your answers to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts