Question: Please answer both questions Question 1 Discuss whether or not you would eliminate the restructuring charges when using earnings to forecast the future profitability of

Please answer both questions

Question 1

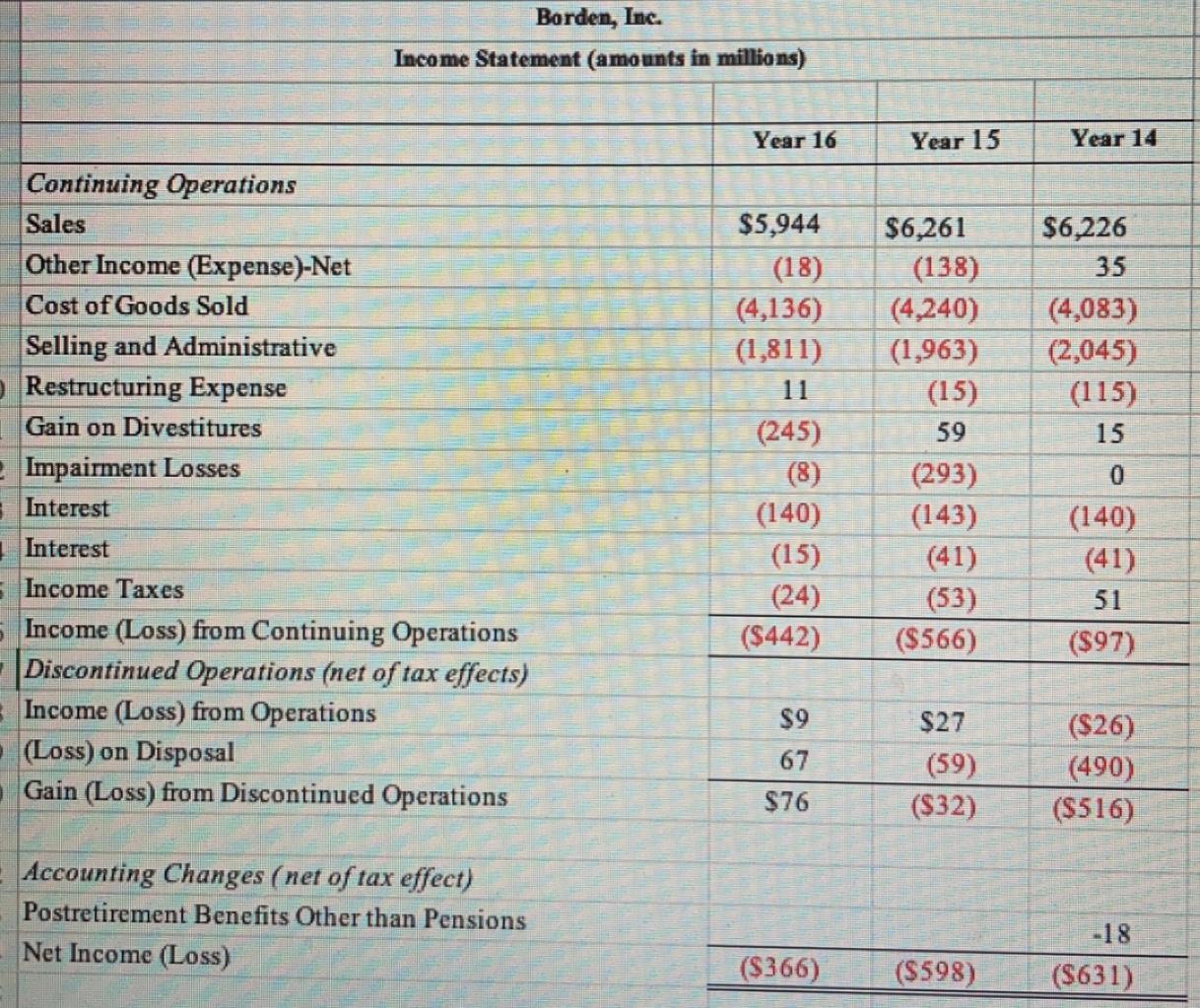

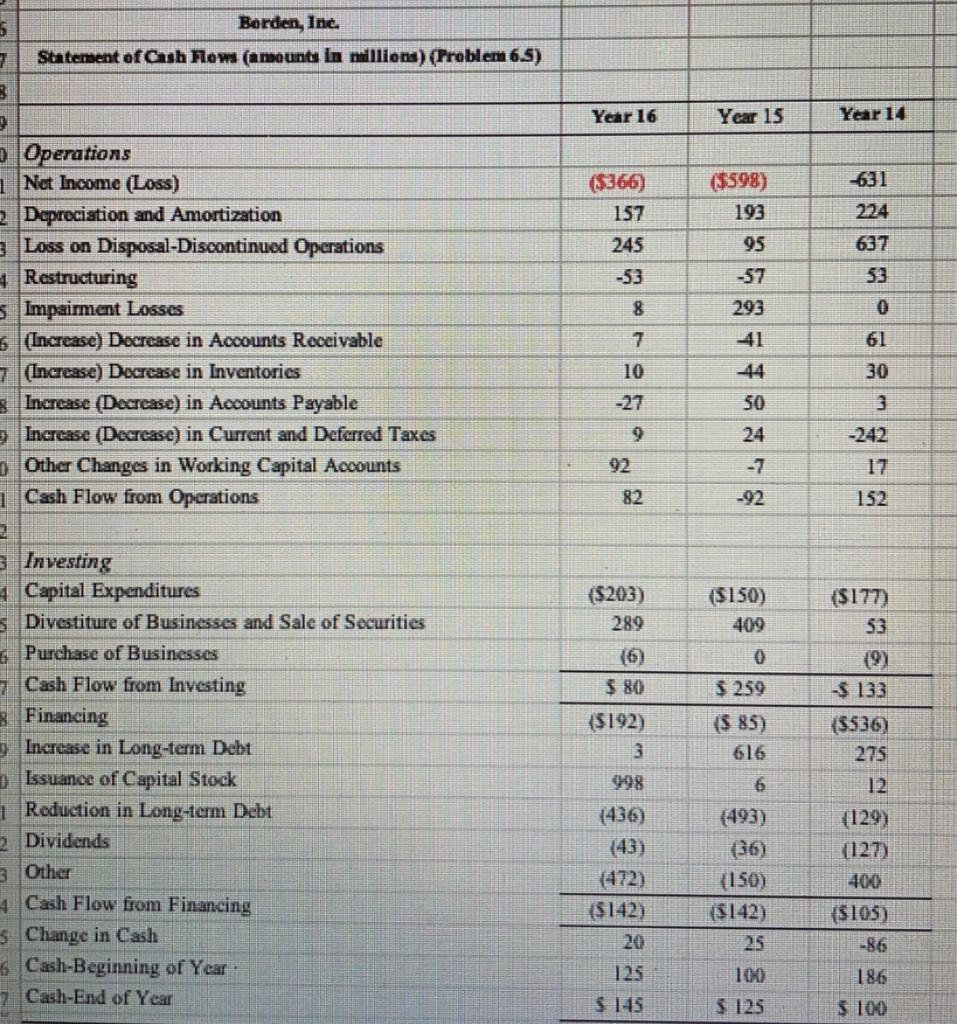

Discuss whether or not you would eliminate the restructuring charges when using earnings to forecast the future profitability of Borden. Two to three good sentences should be sufficient.

Question 2

Discuss whether or not you would eliminate the impairments when using earnings to forecast the future profitability of Borden. Two to three good sentences should be sufficient.

Borden, Inc. Income Statement (amounts in millions) Year 16 Year 15 Year 14 Continuing Operations Sales Other Income (Expense).Net Cost of Goods Sold Selling and Administrative Restructuring Expense Gain on Divestitures Impairment Losses Interest Interest Income Taxes Income (Loss) from Continuing Operations Discontinued Operations (net of tax effects) Income (Loss) from Operations (Loss) on Disposal Gain (Loss) from Discontinued Operations $5,944 (18) (4,136) (1,811) 11 (245) (8) (140) (15) (24) ($442) $6,261 (138) (4,240) (1,963) (15) 59 (293) (143) (41) (53) ($566) $6,226 35 (4,083) (2,045) (115) 15 0 (140) (41) 51 ($97) $9 67 $76 $27 (59) ($32) ($26) (490) (5516) Accounting Changes (net of tax effect) Postretirement Benefits Other than Pensions Net Income (Loss) ($366) ($598) -18 (5631) 5 Berden, Inc. Statement of Cash Now (amounts in millions) (Problem 65) 7 B Year 16 Year 15 Year 14 ($398) 193 631 224 ($366) 157 245 -53 637 95 -57 293 53 8 0 7 41 61 10 44 30 -27 50 9 92 24 -7 -92 3 -242 17 82 152 o Operations 1 Net Income (Loss) 2 Depreciation and Amortization 3 Loss on Disposal-Discontinued Operations 4. Restructuring 5 Impairment Losses 6 (Increase) Decrease in Accounts Receivable 7 (Increase) Decrease in Inventories 3 Increase (Decrease) in Accounts Payable Increase (Decrease) in Current and Deferred Taxes 0 Other Changes in Working Capital Accounts 1 Cash Flow from Operations 3 Investing 4 Capital Expenditures s Divestiture of Businesses and Sale of Securities Purchase of Businesses 7 Cash Flow from Investing Financing Increase in Long-term Debt Issuance of Capital Stock 1 Reduction in Long-term Debt 2 Dividends 3 Other 4 Cash Flow from Financing 5 Change in Cash 6 Cash-Beginning of Year 7 Cash-End of Year {$203) 289 ($150) 409 {$177) 53 0 $ 259 (5 85) 616 6 {6) $ 80 {$192) 3 998 (436) (43) (472) {$142) 20 125 S 145 (9) -3 133 {$S36) 275 12 (129) (127) 400 {$105) -86 (493) (36) (150) ($142) 25 100) 186 $ 125 $ 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts