Question: please answer both questions Question 1 question 2 Jeb is entering high school and is determined to save money for college. Jeb feels he can

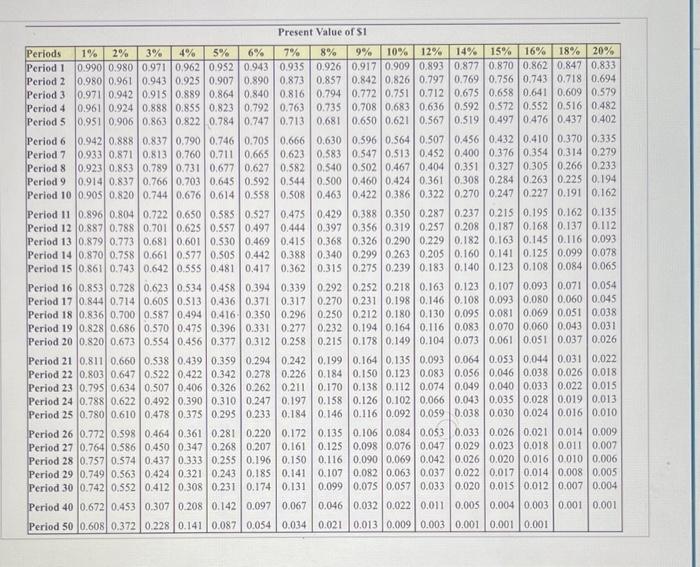

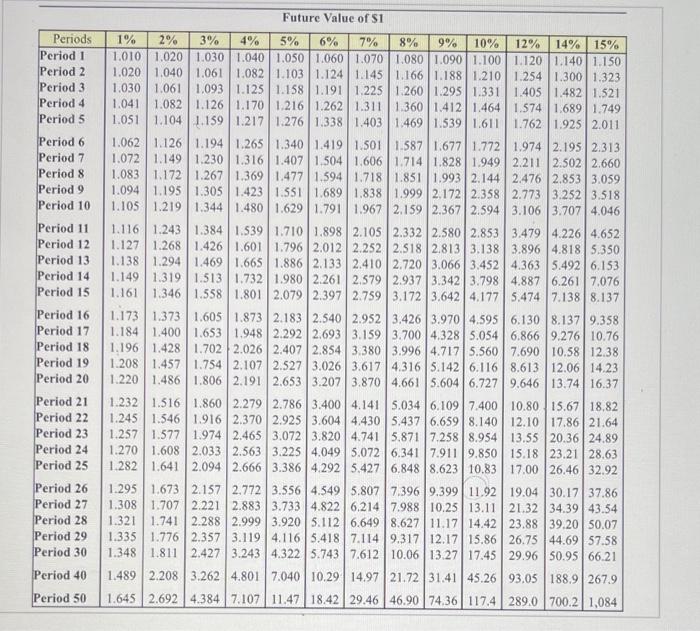

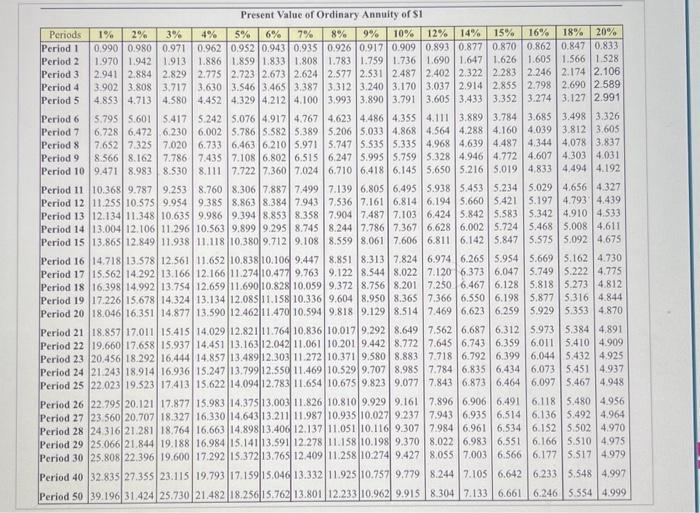

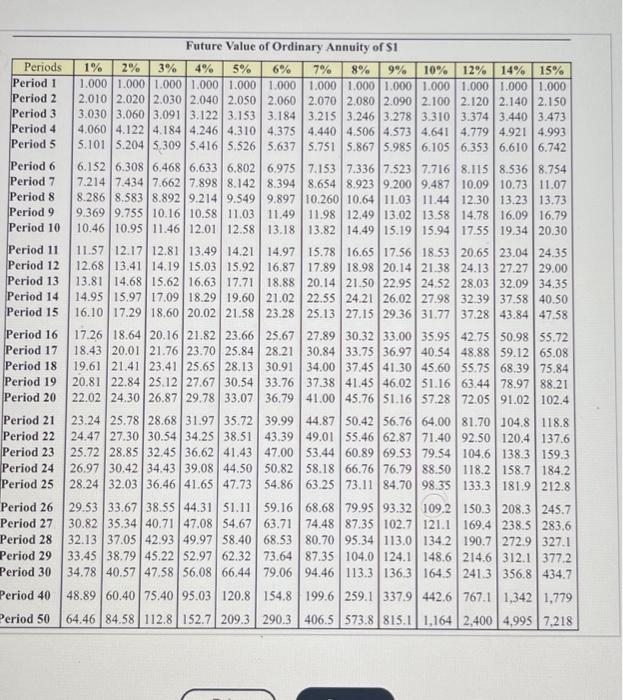

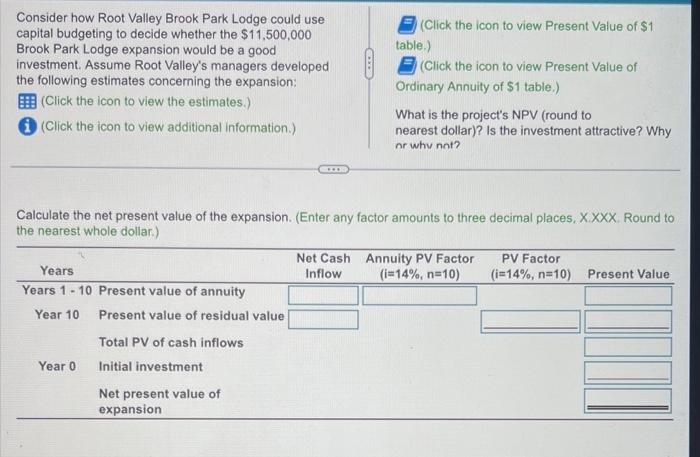

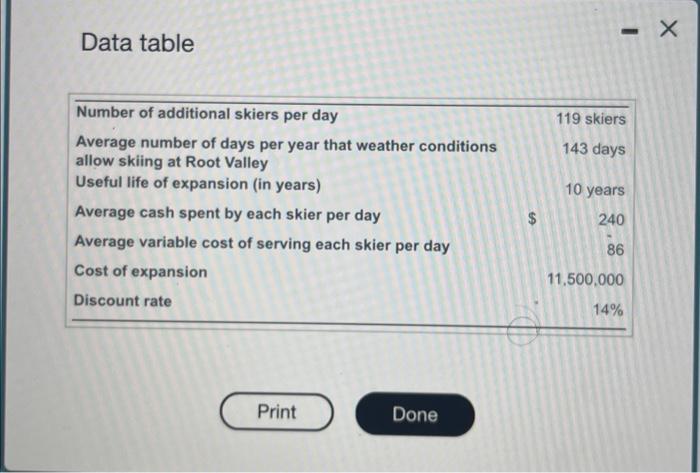

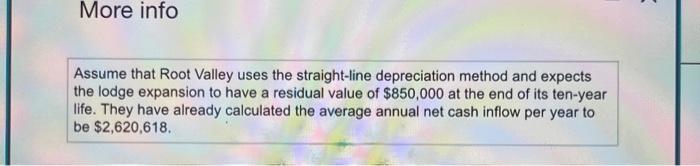

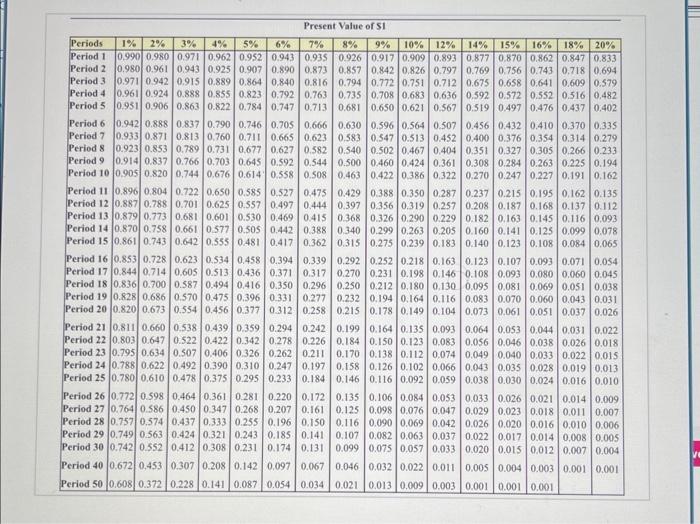

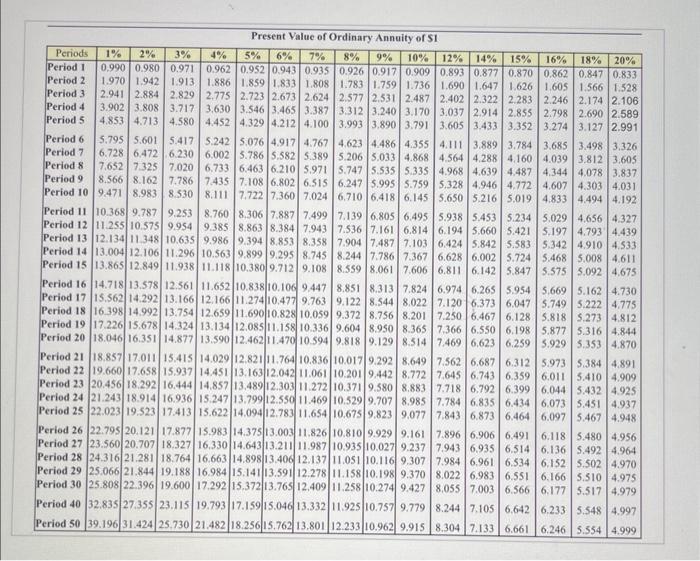

Jeb is entering high school and is determined to save money for college. Jeb feels he can save $1,000 each year for the next four years from his part-time job. If Jeb is able to invest at 4%, how much will he have when he starts college? (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) Click the icon to view Future Value of Ordinary Annuity of $1 table.) (Round your answer to the nearest dollar.) When Jeb starts college he will have Present Value of $1 Future Value of S1 Present Value of Ordinary Annuity of \$1 Future Value of Ordinary Annuity of 51 Consider how Root Valley Brook Park Lodge could use capital budgeting to decide whether the $11,500,000 Brook Park Lodge expansion would be a good (Click the icon to view Present Value of $1 investment. Assume Root Valley's managers developed the following estimates concerning the expansion: (Click the icon to view Present Value of (Click the icon to view the estimates.) Ordinary Annuity of $1 table.) (Click the icon to view additional information.) What is the project's NPV (round to nearest dollar)? Is the investment attractive? Why nr why not? Calculate the net present value of the expansion. (Enter any factor amounts to three decimal places, X.XX, Round to the nearest whole dollar.) Data table More info Assume that Root Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $850,000 at the end of its ten-year life. They have already calculated the average annual net cash inflow per year to be $2,620,618. Present Value of 51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts